| 1. |

8/2015 |

Item 1:Employee Benefit

Whether supply of accommodation with furniture to an employee without consideration is considered as employee benefit?

- Employee benefit is a supply of goods or services by the employer to the employees for free of charge and it must be stated in the contract of employment. The supply made under employee benefit is considered as used for the purpose of business and the input tax incurred by the employer on such goods or services is claimable except for the supply which relates to an exempt supply or block input tax.

- Employee benefit includes supply of accommodation or residential housing to the employee for free of charge but does not include furniture.

- Supply of accommodation under employee benefit which relates to an exempt supply under the GST (Exempt Supply) Order 2014 is considered as used for the purpose of business. The employer is not required to account for GST on the supply of accommodation and is not entitled to claim the input tax incurred on the acquisition of the accommodation.

- However, in the case where -

- the supply of accommodation is inclusive of furniture, the supply of furniture whether or not for consideration is subject to GST. The employer is liable to account for GST accordingly and is entitle to claim input tax incurred on the acquisition of the furniture.

- the supply of accommodation to the employee, benefit of the employee's family irrespective whether it is furnished or unfurnished, the employer is blocked from claiming the input tax incurred.

Item 2:Occupational Health and Safety

Whether the equipment provided by the employer in relation to safety and security requirement under the Occupational Health and Safety Act 1994 is considered as employee benefit?

- Safety and security equipment provided by an employer to the employee for free of charge is considered as employee benefit as long as it is stated in the contract of employment.

- In the case where the employer supplies safety and security equipment for free of charge to the employee and the supply is not stated in the contract of employment, such supply will not be considered as employee benefit. Therefore, the employer is liable to account for the GST and entitle to claim the input tax incurred on the purchase of such equipment. However, where -

- the supply of such equipment involves transfer or change of ownership to the employee, such supply is subject to gift rule under item 5(2)(a)of First Schedule of GSTA 2014; or

- the equipment is subsequently returned to the employer as business asset, the employer is not required to account for the GST.

Item 3:Holding tax invoice as in paragraph 38(4)(a) of the GST Regulations 201

To what extend a person is considered as holding a tax invoice as in paragraph 38(4)(a) of GST Regulations (GSTR) 2014?

- Paragraph 38(4)(a) of GSTR 2014 provides that if a registered person did not claim for the input tax in the taxable period, in which he holds tax invoice, the Director General may allow such person to claim the input tax within 6 years from the date of supply to or importation by him.

- For the purpose of claiming input tax in accordance with paragraph 38(4)(a) of GSTR 2014, a taxable person is considered to hold a tax invoice on the earlier of:

- the date or time of posting the tax invoice into the company Accounts Payable; or

- one year from the date he holds the tax invoice

|

No Amendment |

| 2. |

7/2015 |

Item 1: Claiming input tax on electricity and water expenses invoiced/billed under the owner of the property's name

Claiming input tax on electricity and water expenses invoiced/billed under the owner of the property's name.

- As specified in regulation 38 GSTR 2014 (Goods and Services Tax Regulations), a registered person can only claim input tax credit (ITC) incurred by him if he holds tax invoice in his name.

- In the case of a rented property where the electricity or water invoices/bills are in the name of the property owner, the tenant who is a GST registered person is not allowed to use such invoices/bills for claiming the ITC unless the name in the invoices/bills has been changed into his name.

- However a GST registered person (tenant) is allowed to claim ITC using electricity and water invoices/bills which in the name of the property owner until 31/3/2016 subject to the following conditions -

- The property owner is not a GST registered person;

- There must be a tenancy agreement signed by the property owner and the tenant;

- There must be a clause in the tenancy agreement or a written declaration signed by both the tenant and property owner in a separate document stating that "the input tax on the electricity and water invoices/bills can only be claimed by the tenant. However if the property owner becomes GST registered person, the tenant is not allowed to claim the input tax using such invoices/bills."

- The tenant must keep records of the input tax claimed for the electricity and water invoices/bills under the name of the landlord; and

- The tenant shall stop claiming ITC using electricity and water invoices/bills under the name of the property owner once the property owner becomes a GST registered person. In this case the normal GST rules apply where the landlord will have to issue a tax invoice and charge GST to the tenant. The tenant can use the tax invoice for claiming the ITC.

|

No Amendment |

| 3. |

6/2015 |

Item 1:Tax invoice for disregarded supply and out of scope supply

Tax invoice for disregarded supply and out of scope supply

- Every registered person shall issue a tax invoice when making any taxable supply of goods orservices (s.33 GSTA) including taxable supply which is disregarded and granted relief.

- For the taxable supply which is disregarded or granted relief, the tax element in the tax invoice must be presented as 'NIL' and specified as 'disregarded' or 'relief'.

- No tax invoice shall be issued for an out of scope supply or an exempt supply. However, if the transaction involves a combination of exempt supply and taxable supply, or taxable supply and out of scope supply, the registered person must issue a tax invoice and specify each type of the supply.

Item 2:Repair, maintenance and installation services supplied in relation to an aircraft

Repair, maintenance and installation services supplied in relation to an aircraft

- Repair, maintenance and installation services supplied in relation to an aircraft including parts incorporated which directly benefit a person wholly in his business capacity (and not in his private or personal capacity) are zero rated supply as stipulated in subparagraph 1(d) Second Schedule of GST(Zero Rate Supply) Order 2014.

- These services apply only for supply made by a person who has a valid certificate of approval from the Department of Civil Aviation to do repair, maintenance and installation of an aircraft and include repair and maintenance services of aircraft components, regardless whether with or without the aircraft.

|

No Amendment |

| 4. |

5/2015 |

Item 1:Document for claiming Special Refund

Document for claiming Special Refund

Whether local car manufacturers can use CJP1 form to claim special refund for cars held on hand on 31/3/2015 for which sales tax and excise duty have been paid but yet to be sold to distributor

CJP1 form is the form used for the payment of sales tax prior to GST implementation

CJP1 form can be used as a valid document for local car manufacturer to claim special refund equal to the amount of sales tax that has been paid on the cars held on hand on 31.3.15 provided that:

- The claimant has fulfilled the requirements under S190 of GSTA; and

- the CJP1 form contains list of chassis and engine number of the cars.

Item 2:Claiming Special Refund in respect of imported CBU cars held on hand on 31.3.15

Claiming Special Refund in respect of imported CBU cars held on hand on 31.3.15

Who can claim special refund of full amount of sales tax paid in respect of imported CBU cars held on hand on 31.3.15?

Any person who wants to claim 100% special refund of sales tax paid on imported CBU cars held on hand on 31/3/2015 must:

- have an import document in his name whether as importer, consignee or owner of the car for which sales tax has been paid (paragraph 190(1)(d) GSTA); and

- fulfil other conditions and requirements specified in section 190 and 191 of GSTA.

Item 3:Special Refund on stock of raw materials or components held on hand on 31.3.15

Special Refund on stock of raw materials or components held on hand on 31.3.15

Whether stock of raw materials or components to be used for making a taxable supply held on hand on 31.3.15 for which sales tax has been paid before 1.04.15 are eligible for a special refund claim?

The stock of raw materials or components to be used for making a taxable supply held on hand on 31.3.15 for which sales tax has been paid before 1.04.15 are eligible for the special refund claim with conditions that such stock of raw materials or components -

- have not been used partially or incorporated into other goods;

- must be used only for business purposes; and

- fulfil other requirements set - forth in section 190 GSTA.

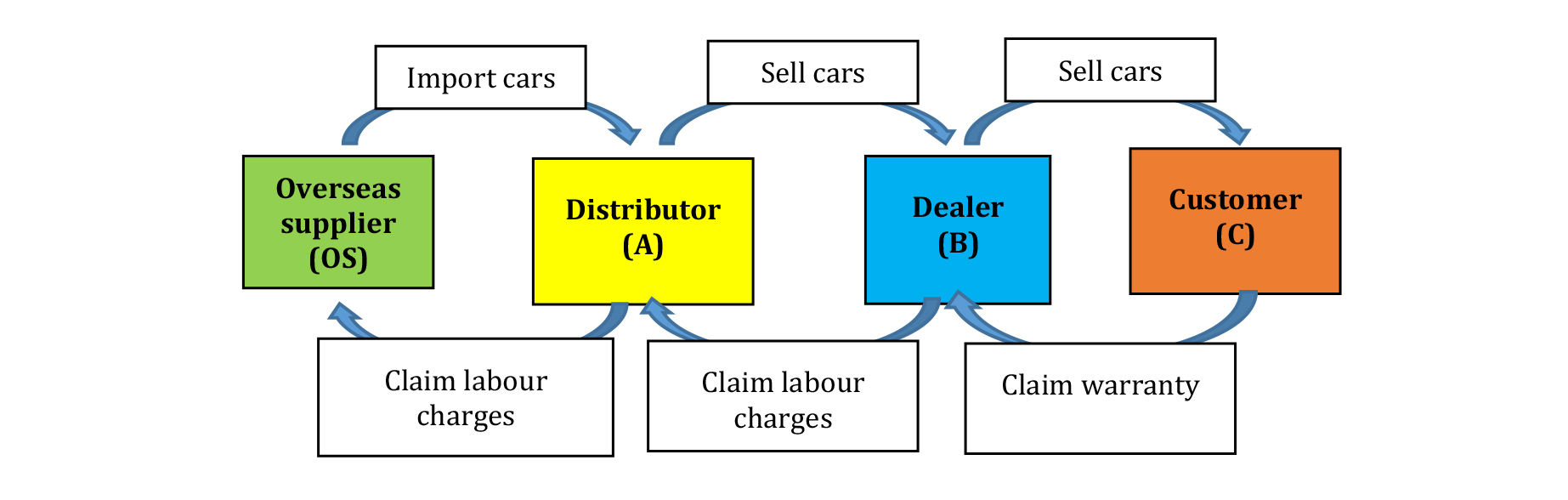

Item 4:Cost recovery under warranty.

Cost recovery under warranty

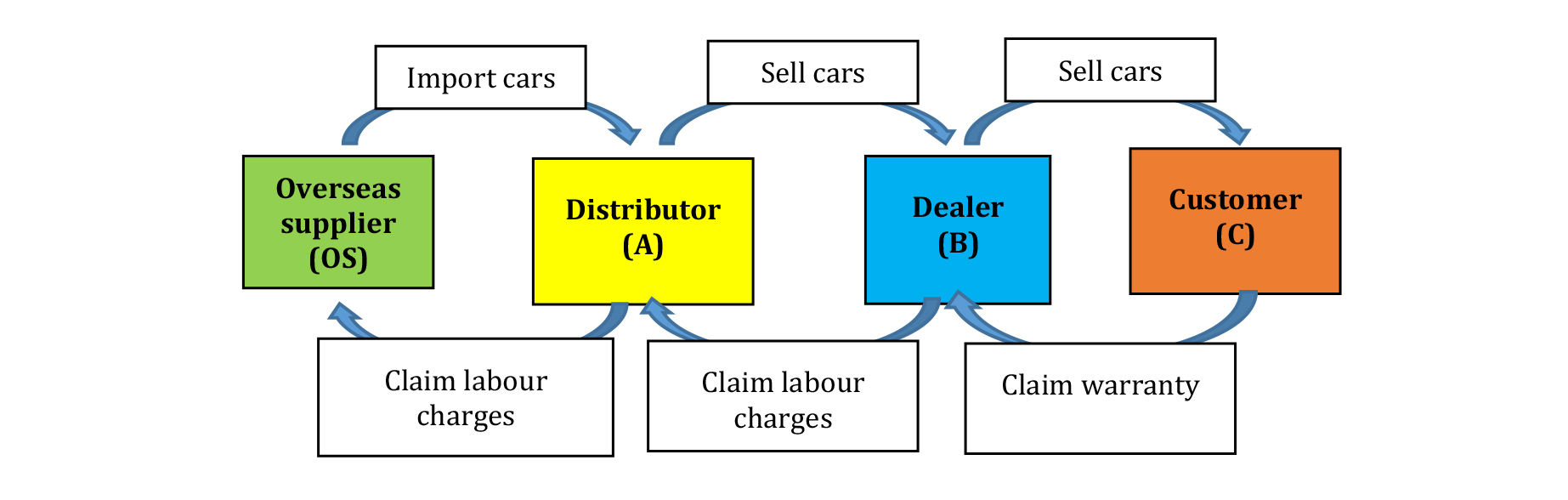

Whether a payment made by an overseas manufacturer/supplier for a warranty claim on provision of services paid by a distributor to a dealer who provide replacement of spare parts/car servicing under warranty at no charge to a customer is subject to GST?

Example:

- A distributor bought cars (under warranty) from overseas supplier and import into Malaysia to be sold to a dealer.

- The dealer sold the car to customer with warranty.

- The customer later claimed warranty on spare parts / car servicing at no charge from the dealer as it is still under warranty.

- The dealer issued warranty claim for labour charges to the distributor.

- The distributor made payment to the dealer on the labour charges.

- The distributor then issue warranty claim to overseas supplier for the payment made to the dealer.

- Section 188(3) GSTA provides that no tax shall be charged on a supply made under a warranty that relates to goods or services whether expressed, implied or required by law and the value of the warranty is included in the price of the goods or services.

-

- Therefore, no tax shall be charged on the supply of spare parts / car servicing under warranty by the dealer to the customer if the value of the warranty is included in the price of the goods or services.

-

- The cost recovery for the labour charges claimed by -

Item 5:A gift of goods worth more than RM500 Whether a registered person is allowed not to account for tax on gift worth more than RM500 when the input tax on such goods is not claimed.

A gift of goods worth more than RM500

Whether a registered person is allowed not to account for tax on gift worth more than RM500 when the input tax on such goods is not claimed.

- A gift of goods made in the course or furtherance of business to the same person in the same year where the total cost to the donor is more than five hundred ringgit, is a supply (refer subparagraph 5(2) First Schedule of GSTA).

- Whether or not a registered person claims the input tax on the goods, the registered person still has to account for GST if the gift of goods is worth more than RM500.

Item 6:Disbursement and reimbursement

Disbursement and reimbursement

What is the GST treatment for disbursement and reimbursement.

- Recovery of expenses may be treated as disbursement or reimbursement and this will depend on whether the expenses are incurred by a principal or an agent acting on behalf of a client.

- GST treatment on disbursement and reimbursement are as follows -

| Disbursement |

Reimbursement |

| Not a supply |

Is a supply |

| Not entitled for input tax claim |

Entitled for input tax claim |

- In general, to determine whether it is a disbursement or reimbursement for GST purposes, registered person must fulfilled all the following criteria -

(wef 28/10/2015)

| Disbursement |

Reimbursement |

| Incur expenses as an agent acting on behalf of the client. |

Incur expenses as a principal. |

| The client is the recipient of the supply(invoice is in the client's name) |

The client is not the recipient of the supply (invoice is in the principal's name). |

| The client is the person responsible to pay for the supply |

The principal is the person responsible to pay for the supply. |

| The payment is authorised by the client. |

The payment is not authorised by the client. |

| The client knew that the supply is made by a third party |

The client has no knowledge that the supply is made by a third party. |

| The exact amount is claimed from the client and the agent has no right to alter or add on the value of the supply |

The principal has the right to alter or add on the value of the supply |

| The payment is clearly an additional to the supply made to the client. |

The payment is for the supply made to the client. |

Item 7:Transport Services: who can be considered as making a supply of transportation services under item 4, Second Schedule of GST (Zero-Rated Supply) Order 2014?

Transport Services

Who can be considered as making a supply of transportation services under item 4, Second Schedule of GST (Zero-Rated Supply) Order 2014?

The transport service provider under item 4, Second Schedule of GST (Zero-Rated Supply) Order 2014 refers to a carrier such as airline or shipping line and includes -

- in relation to passenger, a travel agent or ticketing agent who sell the international travelling ticket acting in his own name.

- in relation to goods, the following -

- shipping agent acting in his own name.

- freight forwarder who contracts with a carrier to move the goods.

- Non-Vessel Operating Common Carrier (NVOCC).

- courier service provider.

|

Amendment |

| 5. |

4/2015 |

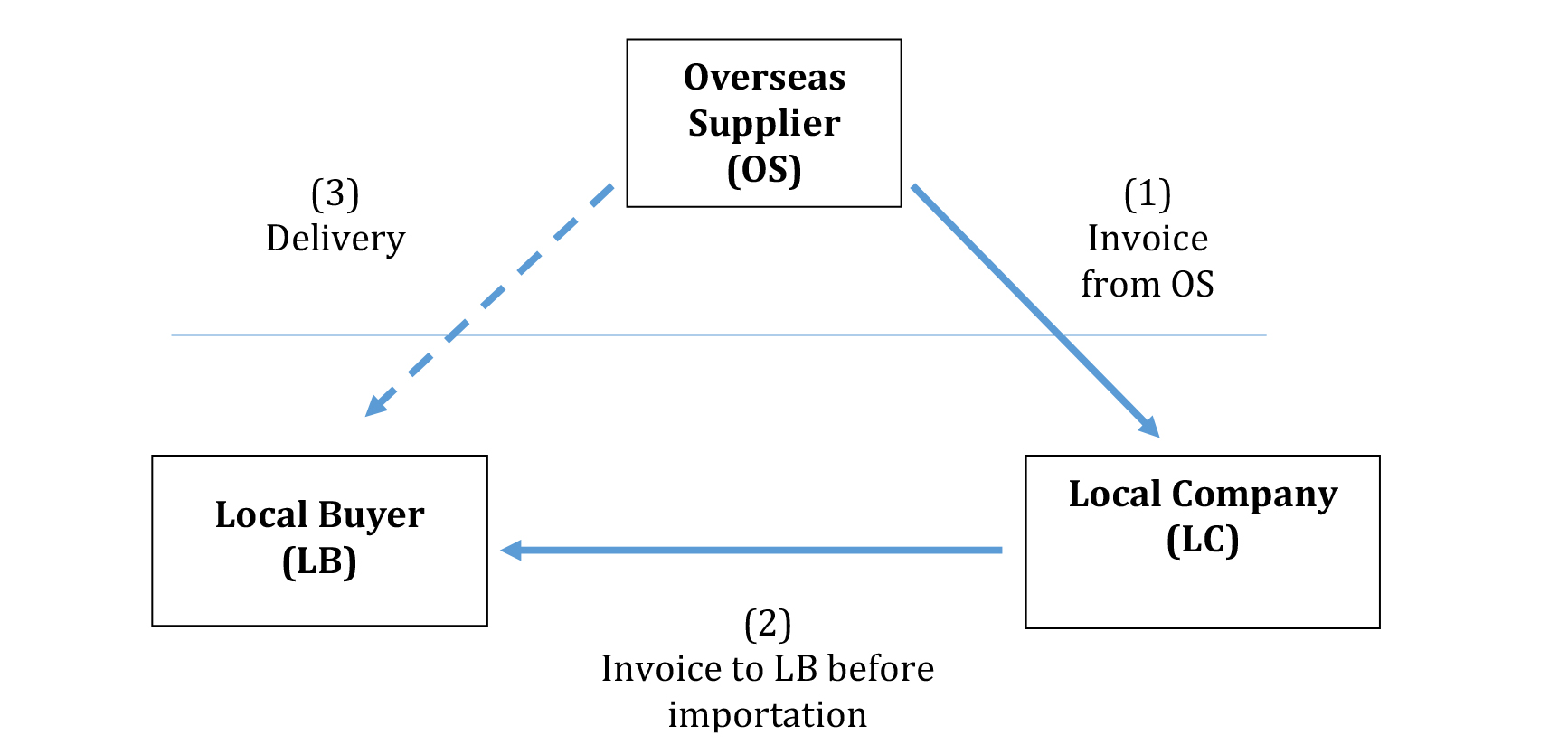

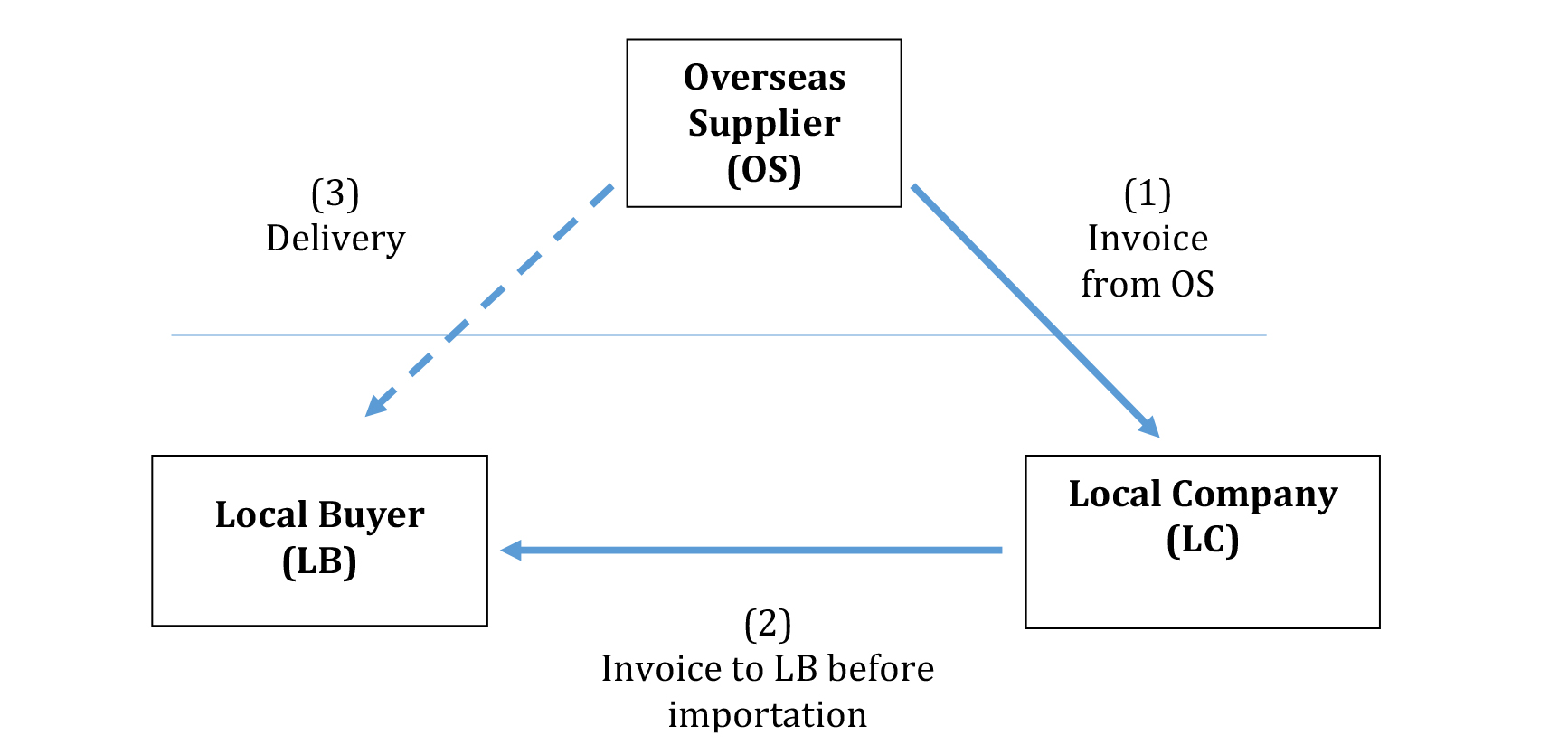

Item 1:Local company (LC) purchased goods from overseas supplier (OS) and later sold the goods to local buyer (LB) and issue an invoice (local invoice). The LC requests the overseas supplier to deliver the goods direct to his local buyer (LB).

Local company (LC) purchased goods from overseas supplier (OS) and later sold the goods to local buyer (LB) and issue an invoice (local invoice). The LC requests the overseas supplier to deliver the goods direct to his local buyer (LB)

Whether the supply made by LC to LB subject to GST?

The supply made by LC to LB will qualify for an out of scope supply, subject to compliance with the following conditions -

- There is proof that the transfer of ownership of the goods took place outside Malaysia before the goods are imported into Malaysia (through shipping document or incoterm);

- The import declaration was in the name of LB and the value of the imported goods was based on the local invoice which stated that the goods are originated from OS;

- LC must keep and maintain the following documents -

- Purchase order from LC to OS;

- Invoice from OS to LC;

- Invoice issued by LC to LB stated that the goods are originated from OS;

(Amended 7/7/2015)

- Written instruction from LC to OS that the purchase goods is to be exported to LB; and

- Proof of payment from LC to OS and from LB to LC;

- LB must keep and maintain the following documents -

- Purchase order from LB to LC;

- Tax invoice issued by LC to LB;

- Proof of payment from LB to LC;

- Import declaration form under LB's name as consignee;

- Bill of lading / airway bill stating the following details:

- OS as the shipper;

- LB as the consignee;

- LC as a notify party.

- Any other necessary conditions as the Director General may require from time to time.

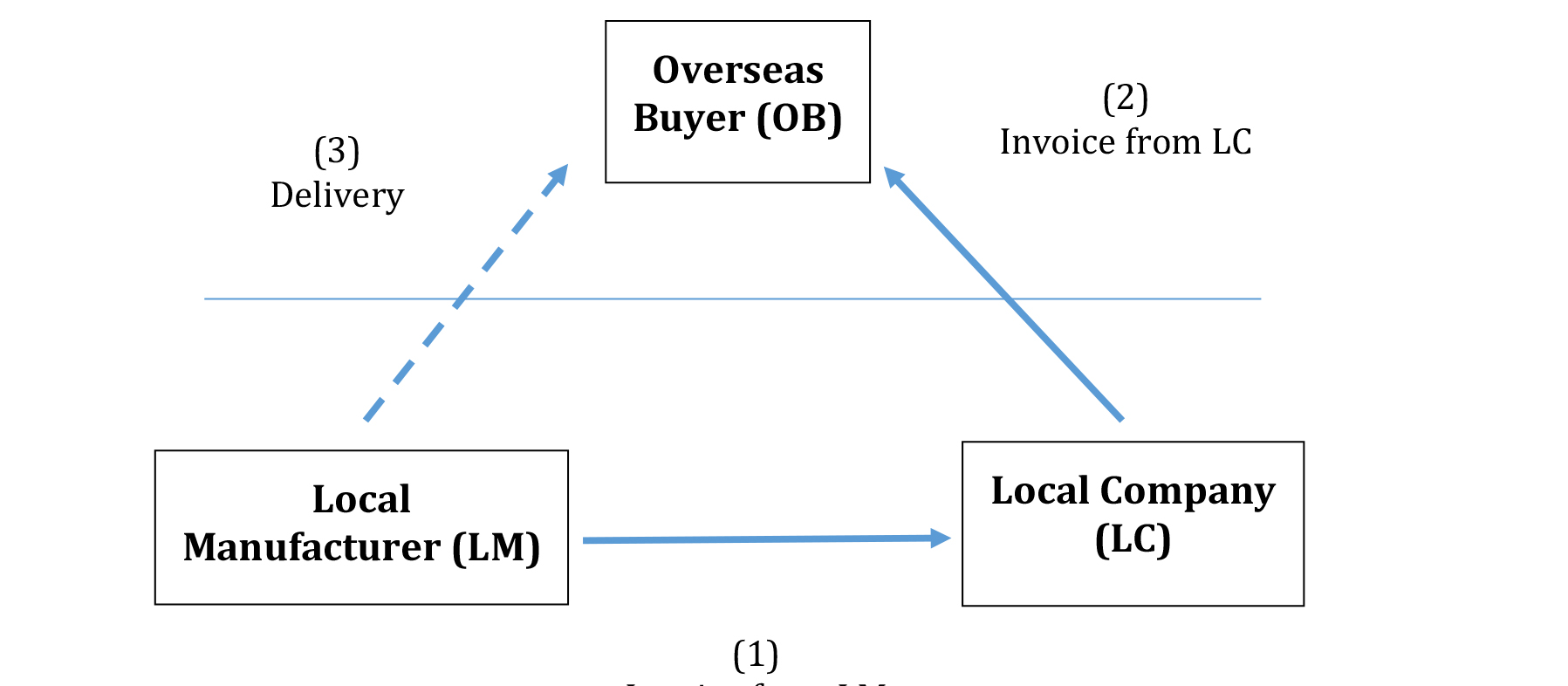

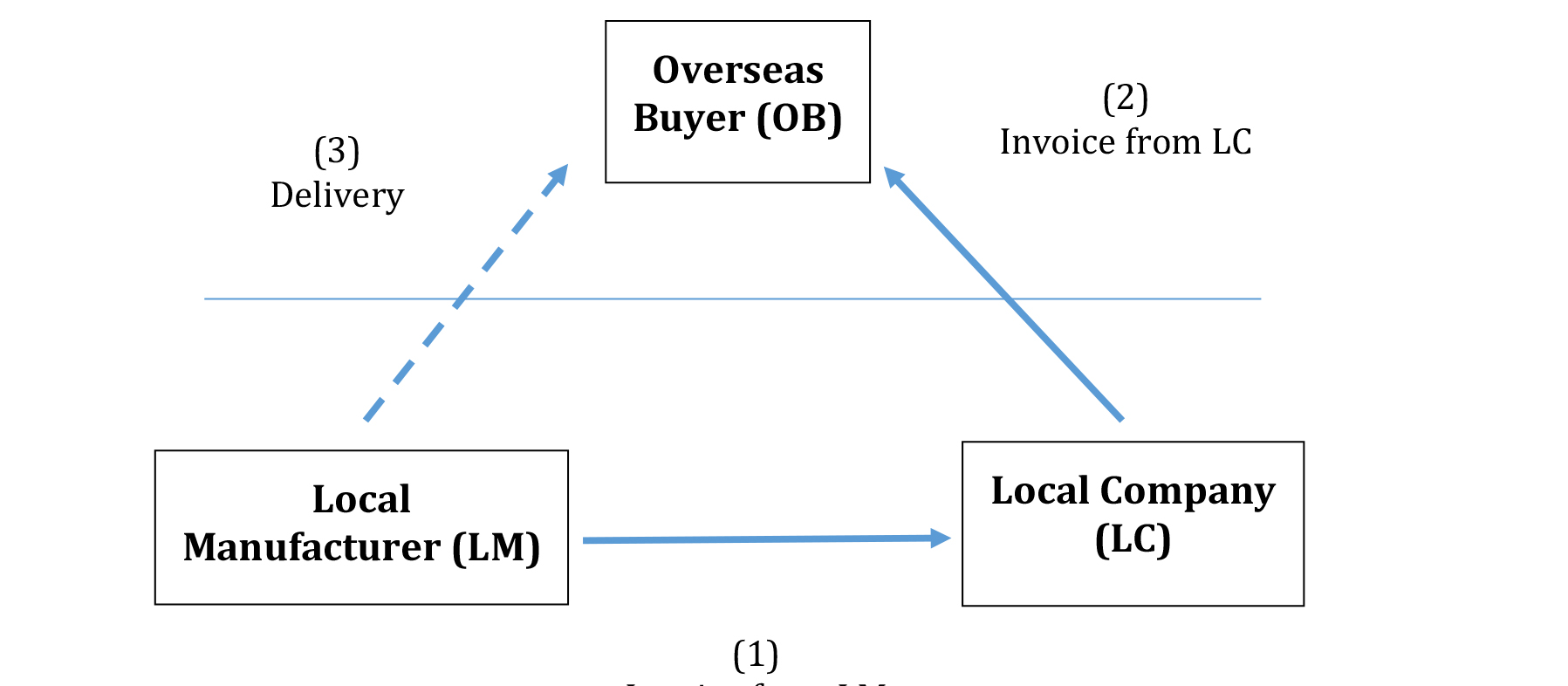

Item 2:Local company (LC) purchased goods from a local manufacturer (LM) and request LM to export the goods to his overseas buyer (OB)

Local company (LC) purchased goods from a local manufacturer (LM) and requestLM to export the goods to his overseas buyer (OB)

Whether the supply made by LM to LC qualify for a zero rate?

- The supply of goods made by LM to LC is a standard rated supply, because the transfer of ownership of the goods took place in Malaysia. However the supply by LM to LC and LC to OB will qualify for a zero rate subject to compliance with the following conditions - (Amended 7/7/2015)

- The supply is related to goods other than wine, spirit, beer, intoxicating liquor, malt liquor, tobacco and tobacco products;

- LM must keep and maintain the following documents -

- Purchase order from LC to LM;

- Tax invoice issued by LM to LC and shipped to OB;

- Written instruction from LC that the purchase goods is to be exported to OB;

- Proof of payment from LC to LM;

- Export document such as K2/K8 where it is stated that the consignor is LM and the consignee is OB; and

- Bill of lading / airway bill stating the following details:

- LM as the shipper;

- OB as the consignee; and

- Indicate under column "Notify Party" the details of OB or his representative and LC as the owner of the goods.

- LM must export the goods within 60 days or any extended period as approved by the Director General (DG) from the time of supply;

- Time of supply for LM is the date of invoice issued or payment received, whichever is the earlier;

- The local company (LC) must keep and maintain the following documents -

- Purchase order from OB to LC;

- Invoice issued by LC to OB; and

- Proof of payment from OB to LC;

AND

- Any other necessary conditions as the Director General may require from time to time.

- If LM does not have possession of the goods to be exported or control over the export arrangement he must treat the sales as local supply and subject to GST at standard rate.

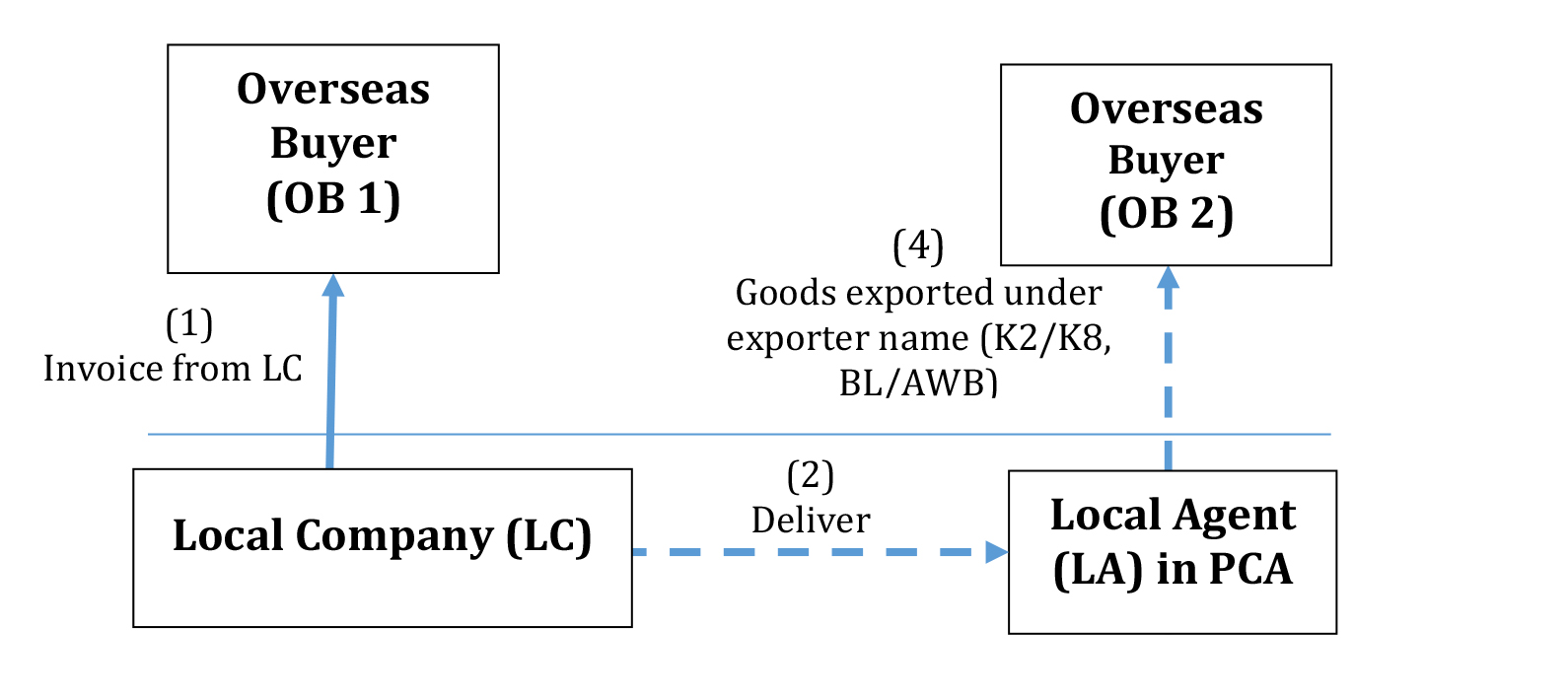

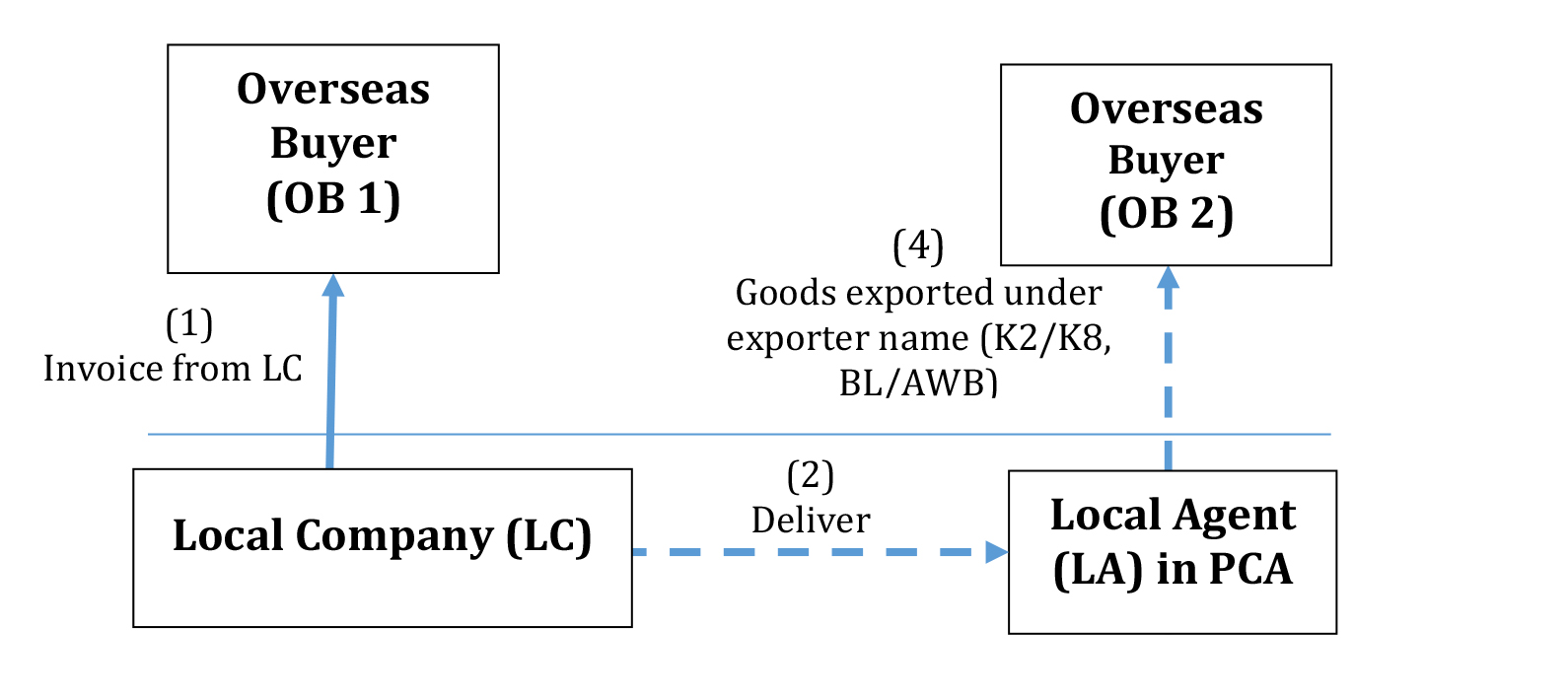

Item 3:Local company (LC) sell goods to overseas buyer (OB 1) and OB1 request the goods to be delivered to his local agent (LA) in PCA and subsequently the goods are exported out by LA to OB1 customer's in other countries (OB2)

Local company (LC) sell goods to overseas buyer (OB 1) and OB1 request the goods to be delivered to his local agent (LA) in PCA and subsequently the goods are exported out by LA to OB1 customer's in other countries (OB2)

Whether the supply made by LC to OB1 can qualify for a zero rate?

- The supply of goods made by LC to OB1 is subject to GST at standard rate and not qualify for zero rate as the goods were delivered into PCA.

- The goods exported by LA to OB2 are zero rated supply with conditions that the export form Customs No.2 and shipping documents indicated that the consignor is LA and the consignee is OB2.

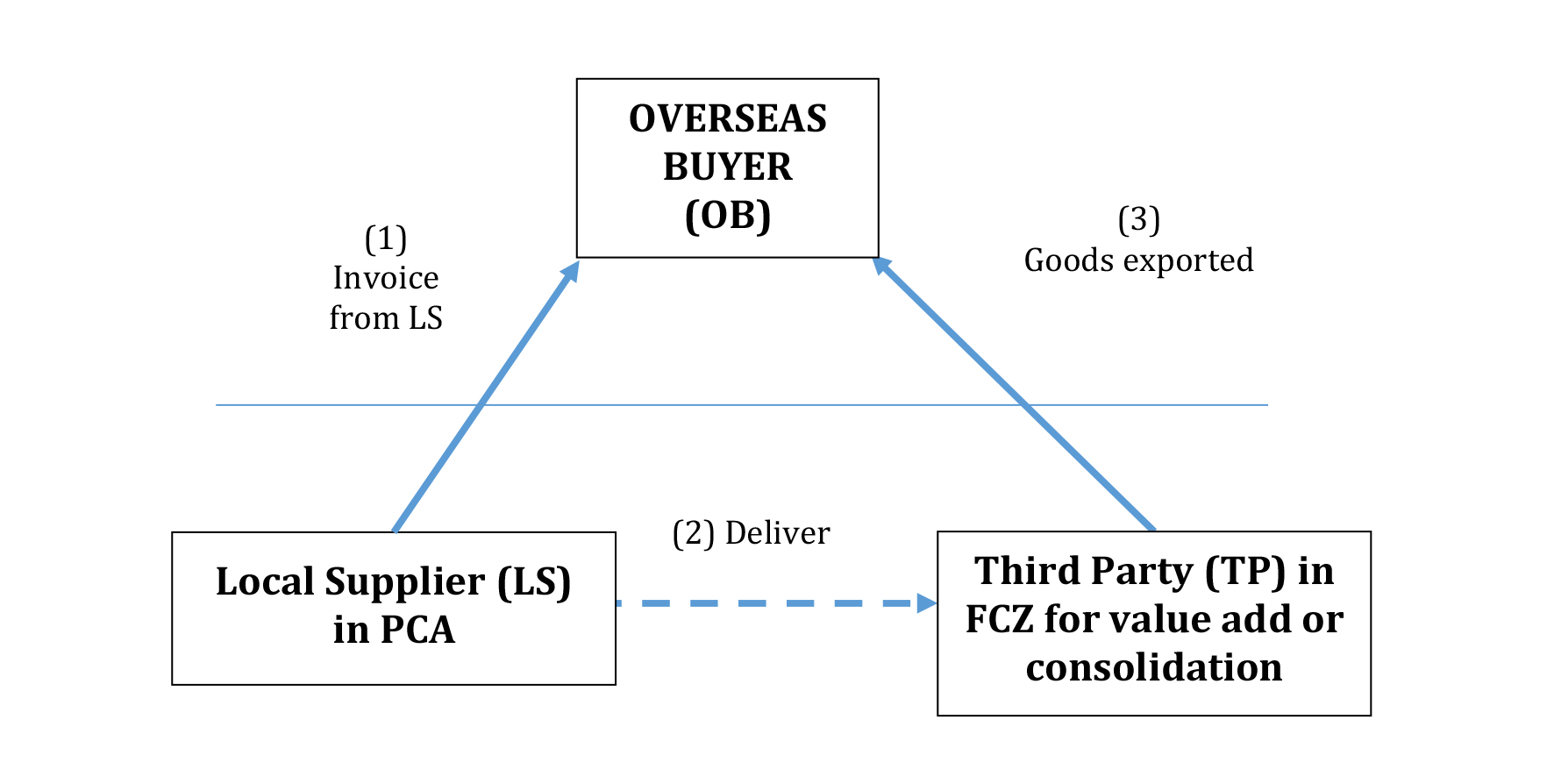

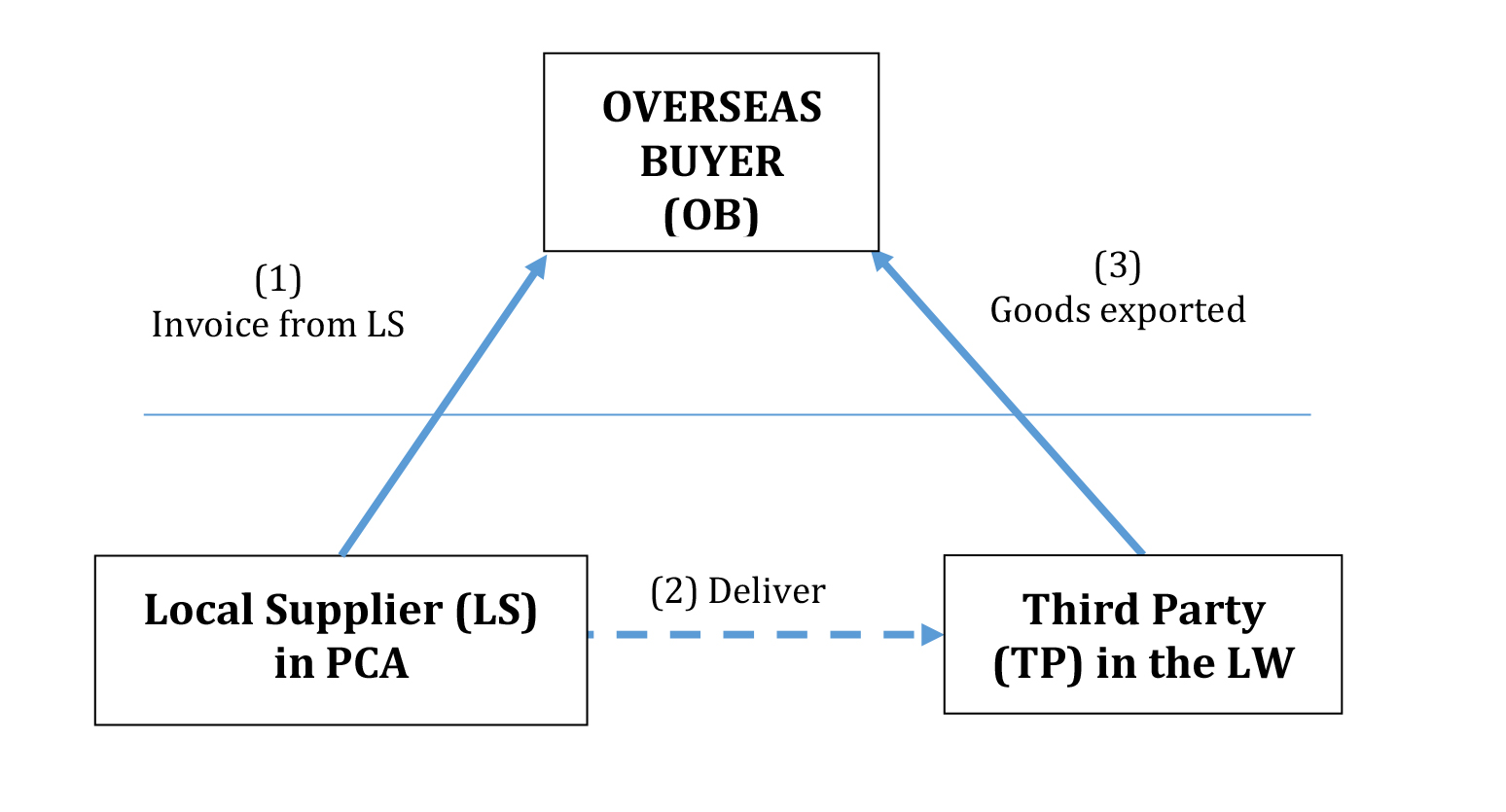

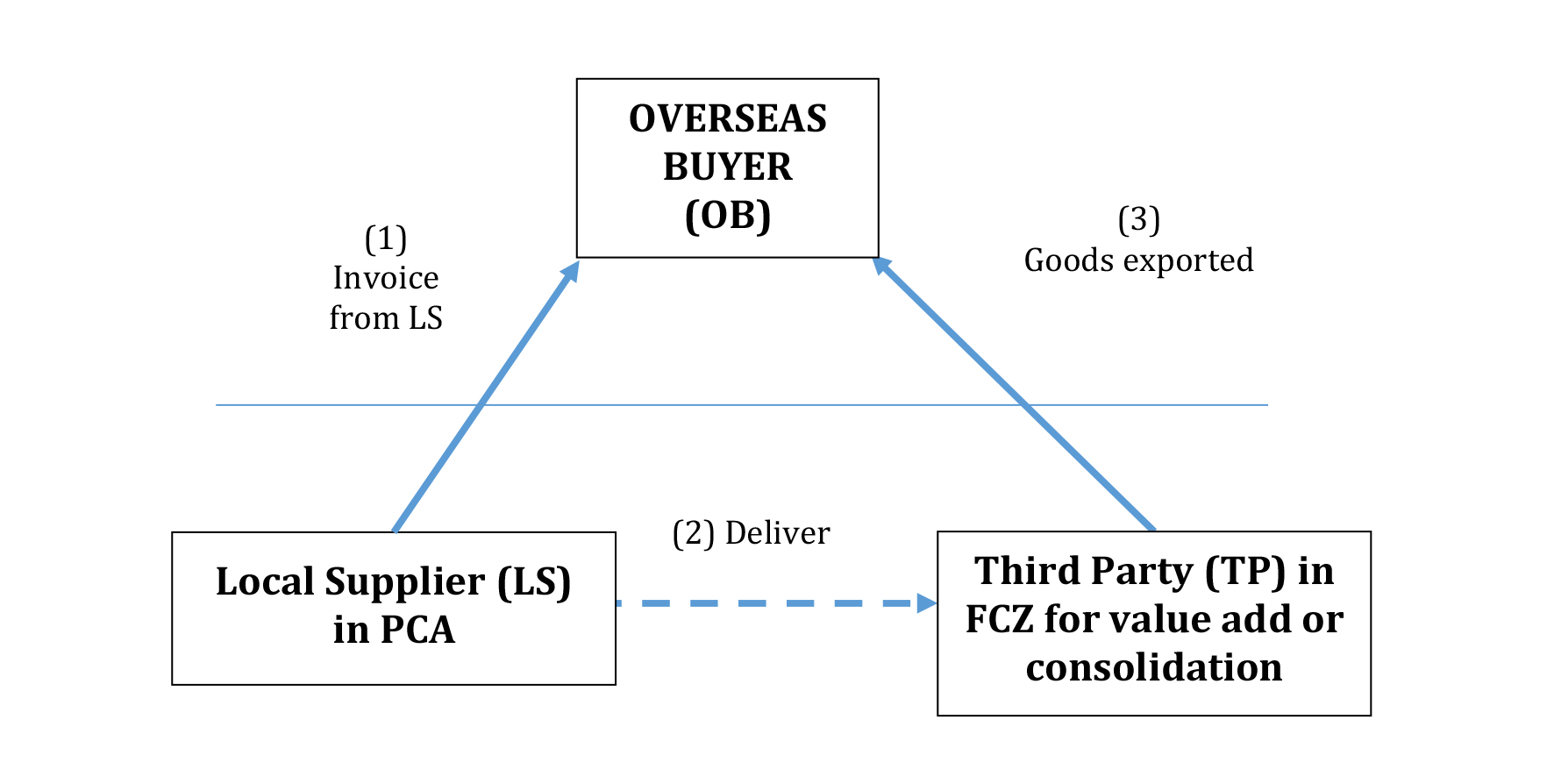

Item 4:Local supplier (LS) sell goods to overseas buyer (OB) and the OB request the goods to be delivered to the third party (TP) in the Free Commercial Zone (FCZ) for value added activity or consolidation

Local supplier (LS) sell goods to overseas buyer (OB) and the OB request the goods to be delivered to the third party (TP) in the Free Commercial Zone (FCZ) for value added activity or consolidation. The third party refers to any agent appointed by the OB.

Whether the supply made by LS to OB qualify for a zero rate?

- Such supply of goods to the overseas buyer (OB) will qualify for a zero rate subject to compliance with the following conditions -

- The supply is related to goods other than wine, spirit, beer, intoxicating liquor, malt liquor, tobacco and tobacco products;

- LS must prove that the goods is physically removed into FCZ and sent to TP;

- LS must keep and maintain the following documents -

- Invoice issued to the overseas buyer;

- Export, transit and other related documents such as customs forms and shipping documents as required under the customs legislation; and

- Written instruction/agreement by the overseas buyer to send the goods to a third party in the FCZ for value added activity or consolidation.

- TP must keep and maintain the following documents -

- Export documents such as invoices, customs forms, free zone forms and shipping documents to prove that the goods have been physically exported overseas; and

- Other related documents received from the supplier.

AND

- Any other necessary conditions as the Director General may require from time to time.

- If the goods are not exported physically overseas, TP is liable to account the GST at a standard rate.

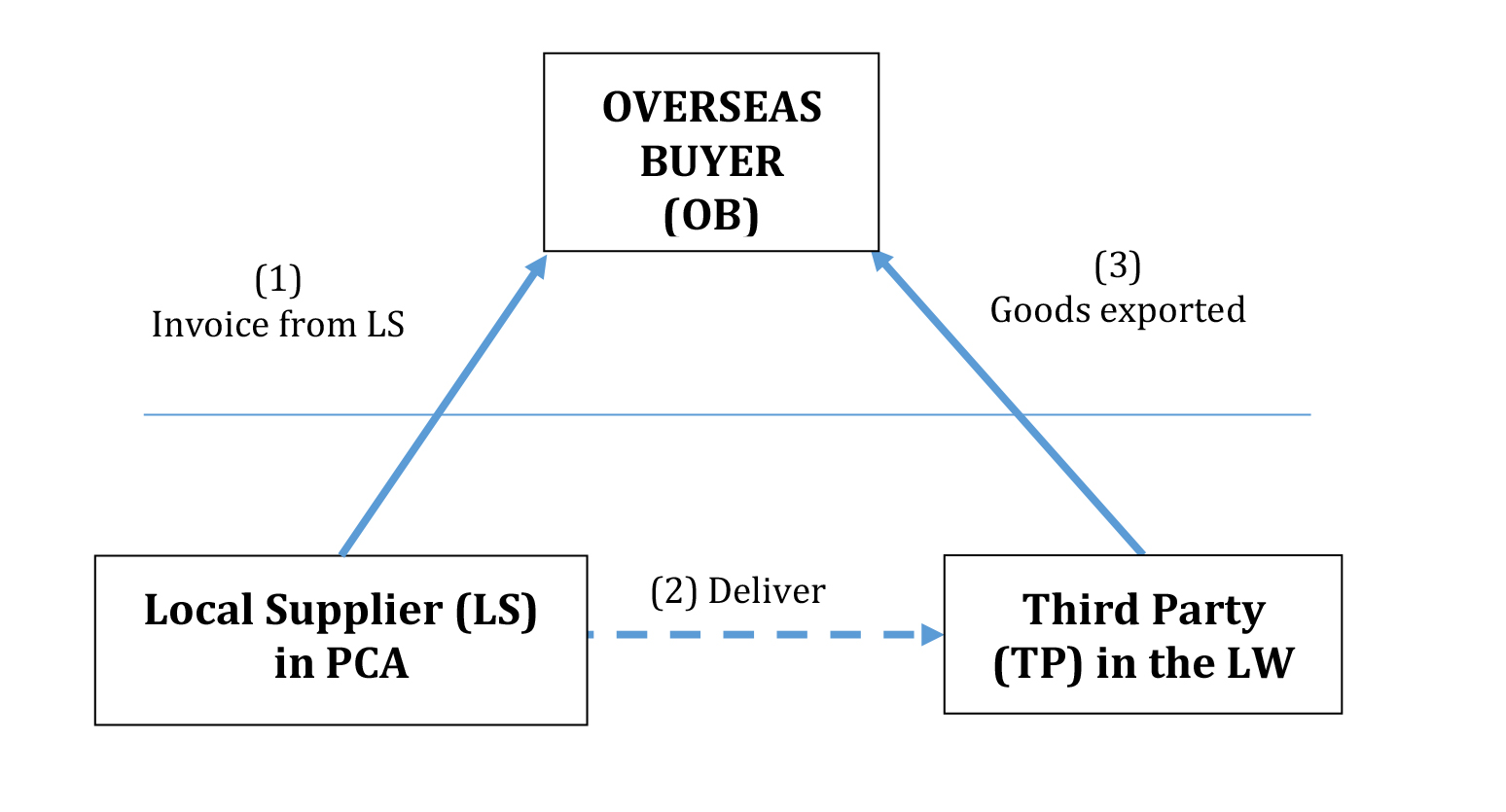

Item 5:Local supplier (LS) sell goods to overseas buyer (OB) and the OB request the goods to be delivered to the third party (TP) in the licensed warehouse (LW) for value added activity or consolidation

Local supplier (LS) sell goods to overseas buyer (OB) and the OB request the goods to be delivered to the third party (TP) in the licensed warehouse (LW) for value added activity or consolidation. The third party refers to any agent appointed by the overseas buyer

Whether the supply made by LS to OB qualify for a zero rate?

- Such supply of goods to the overseas buyer (OB) will qualify for a zero rate subject

to compliance with the following conditions:

- The supply is related to goods other than wine, spirit, beer, intoxicating liquor, malt liquor, tobacco and tobacco products;

- LS must prove that the goods are physically removed into LW and sent to TP;

- LS must keep and maintain the following documents -

- Invoice issued to OB;

- Export, transit and other related documents such as customs forms and shipping documents as required under the customs legislation; and

- Instruction/agreement by OB to send the goods to a third party in the LW for value added activity or consolidation.

- TP must keep and maintain the following documents -

- Export documents such as invoices, customs forms and shipping

documents to prove that the goods has been physically exported overseas;

and

- Other related documents received from the supplier;

AND

- Any other necessary conditions as the Director General may require from time

to time.

-

- The goods removed from the LW must be exported directly to overseas.

- If the goods are not exported physically overseas, TP is liable to account the GST.

Item 6:What is the GST treatment for goods manufactured locally which is supplied or sold by a local supplier to an overseas buyer but the goods are in the possession of the supplier and subsequently released for export in stages as instructed by the overseas buyer?

What is the GST treatment for goods manufactured locally which is supplied or sold

by a local supplier to an overseas buyer but the goods are in the possession of the

supplier and subsequently released for export in stages as instructed by the

overseas buyer?

- Such supply of goods will qualify for a zero rate subject to compliance with the following conditions -

- The supply is related to goods other than wine, spirit, beer, intoxicating liquor, malt liquor, tobacco and tobacco products;

- The supplier must issue invoice before the goods are exported to the overseas buyer;

- The time of supply will be invoice issued or payment received whichever is the earlier;

- The goods are physically exported within 60 days from the time of supply or any extended period as approved by the Director General (DG);

- The supplier must export the goods in his name through his appointed freight forwarder or through his overseas buyer's appointed freight forwarder;

- The supplier must keep and maintain the following documents -

- Agreement with the overseas buyer which shows that they agreed to such transaction;

- The export, transit and other related documents such as customs forms and shipping documents as required under the customs legislation;

- Purchase order from overseas buyer to the supplier;

- Supplier's sale invoice to overseas buyer; and

- Any other records as the DG may determine.

AND

- Any other necessary conditions as the Director General may require from time to time.

- If the goods are not exported physically overseas within 60 days from the time of

supply or any extended period as approved by the Director General (DG), the supply

to the overseas buyer is a standard rated supply and the supplier has to account the

GST at a standard rate.

- The supplier will not qualify for zero rating if he does not have in his possession the

goods to be exported or does not have control over the export arrangement.

Item 7:What is the GST treatment on non-recurring expenditure (NRE) and other manufacturing expenditure connected to manufacture goods to be exported overseas?

What is the GST treatment on non-recurring expenditure (NRE) and other

manufacturing expenditure connected to manufacture goods to be exported

overseas?

The non-recurring expenses (relating to goods) incurred are for the purchase of moulds,

dies, tooling, jigs, fixtures and related equipment used specifically for overseas buyer (OB) in

the contract manufacturer's (CM) premises.

- The non-recurring expenses (NRE) incurred for the purchase of moulds, dies, tooling, jigs, fixtures and related equipment used specifically for overseas buyer (OB) in the contract manufacturer's (CM) premises is not subjected to GST if the cost recovery does not include any element of value add.

Example - purchase of mould by CM is RM100,000 and the recovery from the OC is also RM100,000 hence such cost recovery is not subject to GST.

- The treatment above is subject to compliance with the following conditions -

- Ownership of NRE must be OC and not to be accounted as asset by CM;

- Must have a written agreement/contract between CM and OC regarding the NRE and the exportation of manufactured goods;

- The NRE relating to the purchased goods are used wholly to manufacture goods to be exported to overseas buyer;

- NRE are incurred to manufacture goods according to specifications by OC;

- The CM keeps and maintain export and other related documents such as Customs No.2/8 forms, airway bill, manifest, invoice, purchase order, payment records, etc.;

- When the moulds, dies, tooling, jigs, fixtures and related equipment and its components are no longer to be used as specified in the contract, these goods must be returned to the OC. If such goods are disposed locally, it is subject to GST at standard rate;

AND

- Any other necessary conditions as the Director General may require from time to time.

|

Amendment |

| 6. |

3/2015 |

Item 1:Application for Self Billed Invoice

Application for Self Billed Invoice

- Any registered person (recipient) who meets the requirements and conditions stipulated in section 33 GSTA and regulation 22 GSTR to use a self-billed invoice, may apply for DG's approval by submitting a Self-Billed Invoice Declaration.

- The Self-Billed Invoice Declaration form can be down-loaded from GST portal via Legislation and Guide field.

- The Declaration must be affirmed before a Commissioner of Oath and to be submitted to the customs office, GST Division (controlling station) together with the list of the suppliers who have agreed to a self-billed invoice. The copy of the Declaration is to be kept by the recipient as internal records. (Amended 25/5/2015)

- Once the Declaration has been submitted to the customs office, GST Division (controlling station), the recipient may issue a self-billed invoice without any further approval from DG.(Amended 25/5/2015)

- Additional Declaration must be made and submitted if there is additional supplier.

Item 2:Issuance of tax invoice at the beginning of GST implementation

Issuance of tax invoice at the beginning of GST implementation

- Whether existing stock of invoices can be stamped with the word 'tax invoice' and used by a registered person until the stock last?

- Whether a full handwritten tax invoice can be issued by a registered person?

- The existing stock of invoices which were pre-printed before 1 April 2015 and which were not GST compliant can be used by a supplier who is a registered person until 30th September 2015 or while stock last whichever is the earlier subject to the following conditions -

- the invoices and copies of such invoices must be stamped with the word 'tax invoice' (for full tax invoice), 'GST registration number' and 'rate of tax';

- the invoices and copies of such invoices must contain all particulars prescribed in the regulation 22 of GSTR (GST Regulations 2014);

- the copies of such invoices must be kept and preserved for a period of seven years; and

- beginning 1st October 2015, the registered person excluding 'retailers' must use a computer generated invoice or pre-printed invoice which is GST compliant.

- In the case of 'retailers', they must use a GST compliant point of sale (POS) system or a GST compliant cash register to issue GST tax invoices beginning 1st October 2015.

- The 'retailers' in this item refers to the following categories of businesses -

- Hardware shop.

- Restaurant including coffee shop.

- Mini market, grocery and sundry shop.

- Book store.

- Pharmacy

- Places of entertainment.

- A GST registered person is not allowed to issue any handwritten tax invoices.

Item 2:Issuance of tax invoice at the beginning of GST implementation

Period for issuing tax invoice

When does a supplier need to issue a tax invoice?

- Section 33 GSTA provides that except as otherwise provided in this section, every registered person who makes any taxable supply of goods or services in the course or furtherance of any business in Malaysia shall issue a tax invoice containing the prescribed particulars. Failure to issue a tax invoice is an offence

- Every registered person who makes any taxable supply of goods or services in the course or furtherance of any business in Malaysia shall issue a tax invoice to his buyer within 30 days from the date of payment made by the buyer on such supply (in full or in part). (Amended 7/7/2015)

|

Amendment |

| 7. |

2/2015 |

Item 1:Small Office Home Office (SOHO)

Small Office Home Office (SOHO)

The classification of residential property will be based on the design features and essential characteristics and attribute of the property.

If SOHO meets the above criteria, is the sale of SOHO apartment classified as a residential property?

- Under Paragraph 2, First Schedule of the GST (Exempt Supply) Order 2014 (P.U(A) 271/2014), any buildings or premises being used for residential purposes,designed or adapted for use or intended to be used as dwelling is exempted.

- SOHO can be classified as a residential property if the development of such property comply with the requirement of the Housing Development (Control and Licensing) Act 1966 and Housing Development (Control and Licensing) Rules 1989 as follows -

- letter of planning approval (Surat Kebenaran Merancang) is issued under "residential";

- approved layout plan and approved layout building is for dwelling purpose;

- the sale and advertisement permit is issued under the Housing Development Act (Control and Licensing) 1966, Housing Development (Control and Licensing) Ordinance 2013 or Housing Development (Control and Licensing) Enactment 1978; and (Amended 7/7/2015)

- the developer and the buyer enter into a sale and purchase agreement enforced under the Housing Development Rules (Control and Licensing) 1989, Housing Development (Control and Licensing) Ordinance 2013 or Housing Development (Control and Licensing) Enactment 1978. (Amended 7/7/2015)

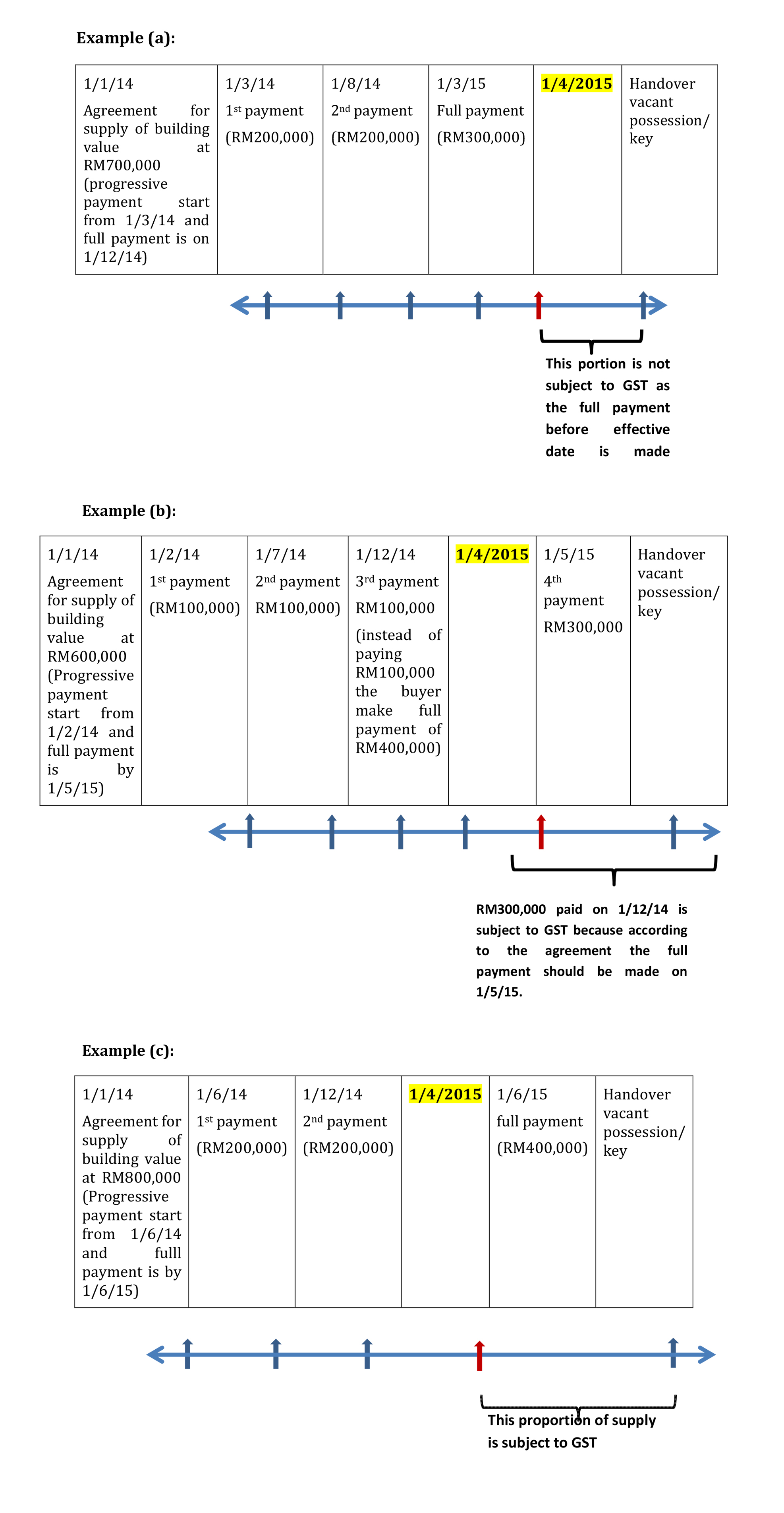

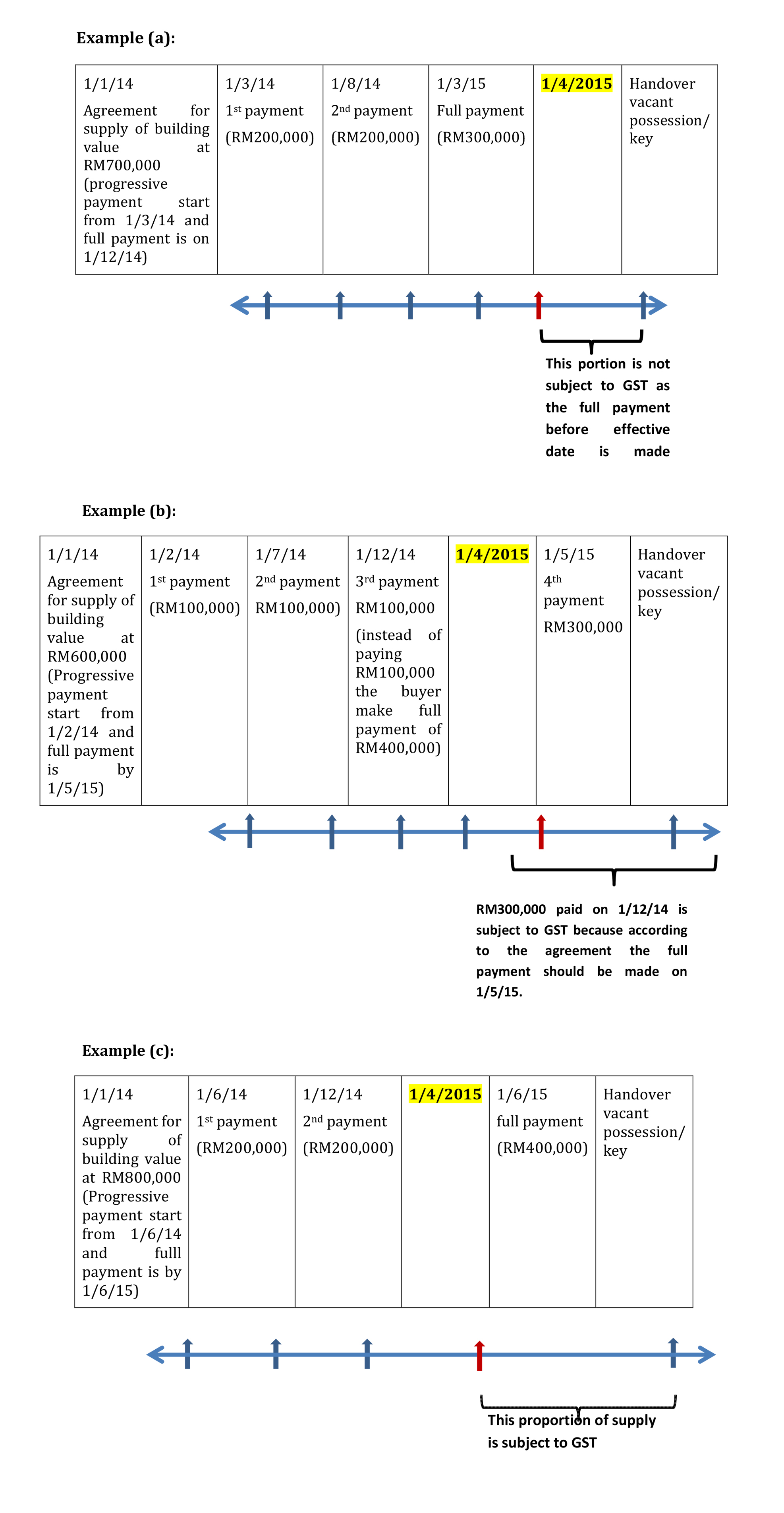

Item 2:Supply of commercial property (build & sell) by the developer to the purchaser under an agreement for a period that begins before the effective date and ends on or after the

Supply of commercial property (build & sell) by the developer to the purchaser under an agreement for a period that begins before the effective date and ends on or after the effective date

What is the GST treatment of such supply?

How to determine the value of such supply if it is subject to GST?

- Supply of commercial property (build and sell) by the developer to the purchaser under an agreement for a period or progressively over a period, whether or not at regular intervals and that period begins before the effective date and ends on or after the effective date the proportion of the supply which is attributed to the part of the period on or after the effective date shall be chargeable to tax. (refer s.188 GSTA)

- Only the value of the proportion of the supply which is attributed to the part of the period on or after the effective date shall be chargeable to tax.

- To determine the value of the supply, the developer must ensure that the method he uses is consistent with the industry practice and acceptable under the General Accepted Accounting Principle (GAAP)

Item 3:Eligibility for deemed Input Tax under Regulation 47 of the GST Regulations 2014 (P.U (A) 190/2014)

Eligibility for deemed Input Tax under Regulation 47 of the GST Regulations 2014 (P.U (A) 190/2014)

- Where an insurer or takaful operator has fulfilled the conditions under sub regulations 47(1), (2) and (3), he is entitled to credit of input tax deemed incurred known as "deemed input tax".

- The insurer or takaful operator is not entitled to credit of deemed input tax when an insurer or takaful operator makes a cash payout to a policyholder/insured or a third party where the cash payout relates to an acquisition of goods or services, which is an exempt supply, zero rated supply, a supply not within the scope of GST or the credit is disallowed under regulation 36.

Item 4:Claiming special refund of sales tax goods held on hand on 1/4/2015

Claiming special refund of sales tax goods held on hand on 1/4/2015

- A person claiming a special refund equal to twenty per cent of the value of the goods hold on the effective date must prove that he has paid the amount as shown on the invoice (refer section 190(2)(C) GSTA). Whether the date of payment is before or after the effective date?

- Does the special refund apply to sales tax goods purchased on 5 March 2015 and paid on 4 April 2015 by reason of 30 days credit term given by the supplier?

- Whether the following goods which are taxable under the Sales Tax Act 1972 which are held on hand on 1/4/2015 and sales tax has been paid before 1/4/2015 are eligible for special refund -

- Unsold stock returned by buyer to the seller.

- Petrol and Diesel.

- Zero rated goods.

- Under section 190 GSTA, a person is entitled for a special refund (100% or 20%) if the goods he holds on hand are taxable under the Sales Tax Act 1972 and the sales tax charged on such goods or the amount shown on the invoice has been paid by the claimant before 1st April 2015. However, if there is a credit term given by the supplier, the special refund is allowed to be claimed only if the total value of the invoice is paid before 30th June 2015. (Amended 7/7/2015)

- The following goods do not qualify for a special refund:

- goods which have been sold and subsequently repurchased (buy back) by the supplier or returned to the supplier before 1st April 2015;

- petrol Ron 95 and diesel; AND

- the goods listed under the GST (Zero Rated Supply) Order 2014.

- Special refund is allowed for unsold stock returned by customer (before 1st April 2015) being the result of delivery of wrong quantity, poor or defective quality of goods or erroneous despatch of un-contracted goods in accordance with Regulation 19C of the Sales Tax Regulations 1972.

Item 5:Whether a debit note is allowed to be issued in order to recover the GST amount during transitional?

Whether a debit note is allowed to be issued in order to recover the GST amount during transitional?

- Tax shall not be charged and levied on any supply of goods or services or importation of goods made before the effective date (s.183(1) GSTA).

- S. 183(3) GSTA provides that the value of the supply under subsection (2) GSTA, the payment received or any amount stated in the invoice issued shall be deemed to be inclusive of tax.

- For the purpose of GST, credit note or debit note is allowed to be issued by any registered person to another registered person only when there is a change in consideration for the supply either due to change of rate of tax in force under s.10 GSTA, a change in the descriptions of the zero rated or exempt supply under section 17 or 18 of the Act or adjustment in the course of business (s.35 GSTA and reg. 25 GSTR)

- During transitional period, a value of supply is deemed to be inclusive of GST. If a debit note is issued after the effective date in order to recover the amount shown on the debit note would be deemed to be part of the total consideration for the supply.

Example;

Invoice issued before effective date for the supply after effective date amounting to RM1000. Debit note raised after effective date RM60.00. Total GST is computed as follows -

6/106 x RM1060 = RM59.99

|

Amendment |

| 8. |

1/2015 |

Item 1:Last date to issue invoice under the Service Tax or Sales Tax

Last date to issue invoice under the Service Tax or Sales Tax

Whether a person licensed under the Service Tax Act 1975 or Sales Tax Act 1972 can still issue invoice or debit note after 1/4/2015 for services rendered or goods sold before 1/4/2015?

- Sections 178 and 181 of GSTA (Goods and Services Tax Act 2014 [Act 762]) expressly provide that though the Sales Tax Act 1972 and Services Tax Act 1975 are repealed, any liability incurred, tax due, overpaid or erroneously paid under those Acts may be collected, refunded, remitted or enforced as if those Acts had not been repealed.

- Sections 179 and 182 of GSTA further provide that, notwithstanding subsections 178 and 181 of GSTA, any person who is licensed under Sales Tax Act 1972 or the Service Tax Act 1975 shall furnish to the Director General (DG) a return for the last taxable period not later than 28 days from 1/4/2015 or such longer period as the DG may determine.

- Section 185 of GSTA provides that sales tax under the Sales Tax Act 1972 or service tax under the Services Tax Act 1975 shall not be chargeable for any sales, used, disposal or importation of taxable goods or any taxable services.

- Decision:

Taxable person under the Sales Tax Act 1972 or the Service Tax Act 1975 sold taxable goods or rendered taxable services on the last taxable period before 1/4/2015 shall -

- furnish a return as required under the Sales Tax Act 1972 or the Service Tax Act 1975 for the last taxable period not later than 28 days from 1/4/2015, unless otherwise determined by the DG;

- issue invoice or debit note which imposes sales tax or service tax not later than 28/4/2015.

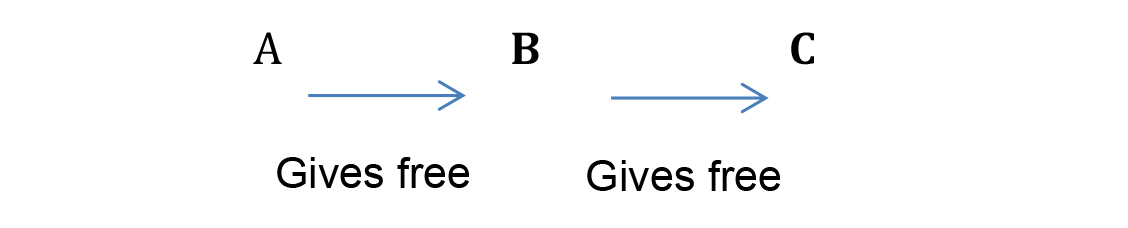

Item 2:Goods received free and given away free

Goods received free and given away free

Regarding gifts above cost of RM500, received by a taxpayer (B) from another taxpayer(A) and subsequently given away free again by B to C after the gift becomes B's business asset -

(i) whether B is entitled for ITC as he received the goods free from A?

(ii) whether B is liable to account for GST when the goods are subsequently given free to C?

- Para 5(1) of the First Schedule of GSTA provides that subject to subparagraph (2), where goods forming part of the assets of a business are transferred or disposed of by or under the directions of the person carrying on the business so as no longer to form part of those assets, whether or not for a consideration, the transfer or disposal is a supply of goods by the person.

- Para 5(2)(a) of the First Schedule of GSTA provides that subparagraph (1) does not apply where the transfer or disposal is a gift of goods made in the course or furtherance of business made to the same person in the same year where the total cost to the donor is not more than RM500;

- Decision

Since B has not incurred any cost on the goods he received from A, B is not entitled to claim input tax credit and is not liable to account for GST when the goods are subsequently given free to C.

Item 3:Eligibility for deemed Input Tax under Regulation 47 of the GST Regulations 2014 (P.U (A) 190/2014)

Item 3:Price display

- Section 8 of the Price Control and Anti-Profiteering Act 2011[Act A1464] provides that where prices of any goods or charges for any services are determined, such prices or charges shall include all government taxes, duties and any other charges.

- For the purpose of GST, price displays, advertises, publishes or quotes by registered person on any taxable supply of goods or services shall include GST unless the DG approves otherwise (Section 9(5) and (7) of GSTA);

- Decision

- All registered person including online business who makes taxable supply of goods or services shall display, advertise, publish or quote the price inclusive GST. However, price displays, advertises, publishes or quotes by registered person on any taxable supply of goods or services may be exclusive of GST subject that they must state the word 'goods or services are subject to GST 6% and the price payable is exclusive of GST' and the supply is made -

- only to another registered person; or

- during transitional period for only 14 days i.e. 1/4/2015 to 15/4/2015. This facility is given for the businesses to complete the process of price labelling or tagging inclusive of GST.

- Online businesses, though the price display must be inclusive of GST, they may notify customers outside Malaysia that the prices payable for goods or services brought out from Malaysia are not subject to GST.

Item 4:Supply of SIM (Subscriber Identification Module) card prepaid or post-paid

Supply of SIM (Subscriber Identification Module) card prepaid or post-paid

i) In Designated Area (Labuan, Langkawi and Tioman).

ii) Free of charge.

- Section 155 provides that notwithstanding section 9, no tax shall be charged on any taxable supply of goods or services made within or between the Designated Area (DA) unless the Minister otherwise directs in an order under section 160 of GSTA.

- Under item 2(c) of the GST (Imposition of Tax for Supplies in respect of DA) Order 2014 [P.U(A)187/2014], tax shall be imposed at the rate fixed under subsection 10(1) of the Act on telecommunication services supplied within or between DA.

- Decision

- Supply of SIM card is a supply of right to use telecommunication services and it is a supply of services.

- Supply of SIM card in a DA is subject to GST.

- Supply of SIM card in a DA to a non-connected person for free of charge is not a supply and not subject to GST.

Item 5:Approval for Simplified Tax Invoice)

Approval for Simplified Tax Invoice

- Section 2 of GSTA defines 'tax invoice' means an invoice required to be issued by a taxable person under section 33 of GSTA.

- Any registered person who makes taxable supply of goods or services in Malaysia shall issue a tax invoice containing particulars prescribed in regulation 22 of Goods and Service Tax Regulations 2014 [P.U.(A)190/2014] (GSTR) unless otherwise approved by the DG (section 33(1) of GSTA).

- Section 33(3)(a) of GSTA provides that the DG may approve written application made by a registered person to exclude prescribed particulars subject to conditions as he deems fit to impose. However, the registered person shall include the recipient name and address in the tax invoice upon request by the recipient.

- Simplified tax invoice refers to tax invoice without full particulars prescribed in regulation 22 GSTR and this tax invoice can only be issued by a registered person who has been granted approval by the DG.

- Decision

DG pursuant to section 33(3)(a) of GSTA gives his approval (blanket) to any registered person who makes a supply to end consumer (not businesses), to exclude following particulars in their tax invoices -

- the word 'tax invoice'(reg. 22(a) GSTR);

- name and address of the recipient (reg.22(e) GSTR);

- the total amount payable exclusive of tax.

|

No Amendment |

| 9. |

4/2014 |

Item 1:Supply by Societies and Similar Organizations (Including Charitable Entities)

Supply by Societies and Similar Organizations (Including Charitable Entities)

How to determine whether the value of supply is nominal or not?

- Paragraph 3(a) Schedule 2 of the GSTA (Goods and Services Tax Act 2014), provides that supply of goods or services by any society or similar organization registered under any written law shall be treated as not a supply where the supply to its members relates to its aims and objectives and available without payment other than a membership subscription and the value of such supply is nominal.

- The value of supply is treated as nominal when the cost of supply made by the society or similar organizations to each of its member in a year does not exceed RM100 (one hundred ringgit Malaysia).

Item 2:Issuing tax invoice before effective date.

Issuing tax invoice before effective date

Whether businesses can issue tax invoice with GST NIL to their customers before effective date on the trial basis?

- Section 183 GSTA provides that, tax shall not be charged and levied on any supply of goods or services or importation of goods made before the effective date.

- Businesses can issue tax invoice with the words 'GST NIL' to their customers one(1) week before effective date on the trial basis and it must indicate that it is for trial only.

Item 3:Issuing tax invoice for exempt supply.

Issuing tax invoice for exempt supply

For the purpose of reducing compliance cost, can a mixed supplier who is GST registered, instead of issuing normal invoice, issue a tax invoice when making only exempt supply?

- Every registered person who makes any taxable supply in the course of his business shall issue a tax invoice containing the prescribed particulars (section 33(1) GSTA).

- A non-registered person shall not issue invoice showing an amount which purports to be a tax.(section 33(10) GSTA)

- No person shall issue invoice showing an amount which purports to be a tax on non-taxable supply. (section 33(10)GSTA)

- To avoid confusion to the consumer, the GST registered supplier must not issue tax invoice when making only exempt supply (non-taxable supply).

Item 4:Registration of receiver or liquidator

Registration of receiver or liquidator

- How the receiver or liquidators need to register GST during GST era?

- Who should apply for registration, in the case where a company has been wound up before 1.4.2015 but the business operations of making taxable supply were taken over and run by the Receiver and the thresholds after 1.4.2015 is expected to exceed RM500,000?

- Registration -

- If the receiver or liquidator is acting under employment of a company and his services are paid to the company, the company will have to apply for the registration.

- If the receiver or liquidator is acting on his private capacity, he himself will have to apply for the registration.

- In the case where a company has been wound up before 1.4.2015 but the business operations of making taxable supply were taken over and run by the Receiver and the thresholds after 1.4.2015 is expected to exceed RM500,000, the receiver or liquidator will have to apply for the registration.

Item 5:Supply of goods under lease agreement from Designated Area (DA) to Principal Custoen Area (PCA)

Supply of goods under lease agreement from Designated Area (DA) to Principal Customs Area (PCA)

- Whether supply of goods under lease agreement from DA to PCA subject to GST?

- What if the goods supplied from DA to PCA are not return back to DA after the expiry of the lease agreement but are supplied to another person in PCA under a new lease agreement?

- If such goods under lease agreement are supplied from DA to PCA before 1.4.2015 and the agreement ends on or after 1.4.2015 is subjected to GST?

Note:

- PCA refers to Malaysia other than DA.

- DA refers to Labuan, Langkawi and Tioman

- Tax shall be due and payable upon all goods including any goods under any lease agreement supplied from a DA to PCA to all intents as if the supply were importation into Malaysia (section 156(a) GSTA).

- Tax shall be charged on taxable supply of services made by any taxable person from a DA to PCA or from PCA to a DA but excluding a supply of services which comprises the use of goods under any lease agreement from a DA to Malaysia (section 156(b) GSTA).

- Section 157 GSTA provides that notwithstanding any provision of this Act, tax shall be charged on all goods or services supplied within Malaysia by a taxable person whose principal place of business is located in a DA.

- Importation of goods under lease agreement supplied from DA to PCA is subjected to GST as if the supply were importation into PCA and the collection of tax due and payable shall be made in a DA.

- If the goods supplied from DA to PCA are not return back to DA after the expiry of the lease agreement but are supplied to another person in PCA under a new lease agreement, such supply of leasing services is subjected to GST.

- If goods under lease agreement are supplied from DA to PCA before 1.4.2015 and the agreement ends on or after 1.4.2015, the proportion of the supply as leasing services on or after 1.4.2015 shall be subjected to GST.

- Supplier in DA shall register if his threshold of supply for the leasing services to PCA is more than RM500,000 and will have to charge GST.

Item 6:Individual supply commercial property

Individual supply commercial property

Whether an individual has to charge GST when making a supply of his commercial property?

- GST shall be charged by a taxable person in the course or furtherance of business on any taxable supply of goods or services made in Malaysia (section 9 GSTA).

- Taxable person means any person who is or is liable to be registered under section 2 GSTA. A person is liable to be registered if his total taxable supply of the current month and the next eleven months exceeds RM500,000.

- Any individual who is not a GST registered person is treated as carrying out a business if he at any one time owns - (wef 28/10/2015)

- more than 2 commercial properties;

- more than one acre of commercial land; OR

- commercial property or commercial land worth more than 2 million ringgit at market price;

- Any individual mentioned in paragraph (iii) is liable to be registered as a GST registered person if - (wef 28/10/2015)

- he has the intention to supply any of his commercial properties or commercial land; AND

- the total value of such supply exceeds the prescribed threshold in 12 months periods.

- 'at any one time' mentioned in paragraph (iii) means at any point of time in his lifetime commencing after the effective date. (wef 28/10/2015)

- Any individual is treated as carrying out a business and making a supply of taxable service if: (wef 28/10/2015)

- he is supplying any lease, tenancy, easement, licence to occupy or rent ; AND

- his annual turnover for such supply has exceeded the prescribed threshold in the period of 12 months.

Item 7:Land Development Agreement between a land owner and a developer

Land Development Agreement between a land owner and a developer

When there is a land development agreement between a land owner and a developer to develop a land, can the developer issue invoice to the buyer under the developer's own name and account for output tax?

When there is a land development agreement between a land owner and a developer (Parties) to develop a land - (Amended 31/3/2015)

- In relation to commercial properties -

- the land owner (if registered) must -

- issue a tax invoice and charge GST to the developer based on the amount of land owner's entitlement (as per the terms of such land development agreement entered by parties) for the supply of rights to use the land or for the supply of land; and

- account the GST.

- the developer must issue a tax invoice under his name to the end buyer and charge GST on the supply of developed property at the gross development value (GDV);

- the developer can claim GST paid as his input on -

- his acquisition of rights to use the land or supply of land from the land owner; and

- cost incurred in relation to those directly used for the development of the commercial properties(if registered);

- In relation to mixed supplies (Commercial and Residential Properties)-

- if the approved used of land has not been established by the Parties, the land owner (if registered) must -

- issue a tax invoice and charge GST to the developer based on the amount of land owner's entitlement (as per the terms of such land development agreement entered by parties) for the supply of rights to use the land or the supply of land; and

- account the GST.

- if the approved used of land is established by the Parties (supported by SuratKebenaran Merancang and Approved Master Layout Plan as documentary evidences), the land owner must -

- issue a tax invoice and charge GST to the developer based on the amount of land owner's entitlement (as per the terms of the agreement entered by parties) for the supply of rights to use the land or the supply of land which relates to commercial portion only; and

- account the GST.

- The developer must issue a tax invoice under his name and charge GST to the end buyer on the supply of the developed commercial properties at the gross development value (GDV).

- The developer -

- can claim input tax incurred in relation to those inputs directly used for the supply of the commercial properties;

- cannot claim input tax incurred in relation to those inputs directly used for the supply of the residential properties; and

- must apportion the input tax incurred for both residential and commercial properties (residual) based on apportionment formula.

- In relation to exempt supplies (Residential Properties) -

- The land owner (if registered) cannot charge GST to the developer on the supply of rights to use the land or supply of land;

- The developer must charge GST on fixtures and fittings and marketing services on the land owner's entitlement (if the developer market the developed property own by the land owner).

* GDV is referred to the total selling price to the end buyer

Item 8:Supply of land or property during transitional period.

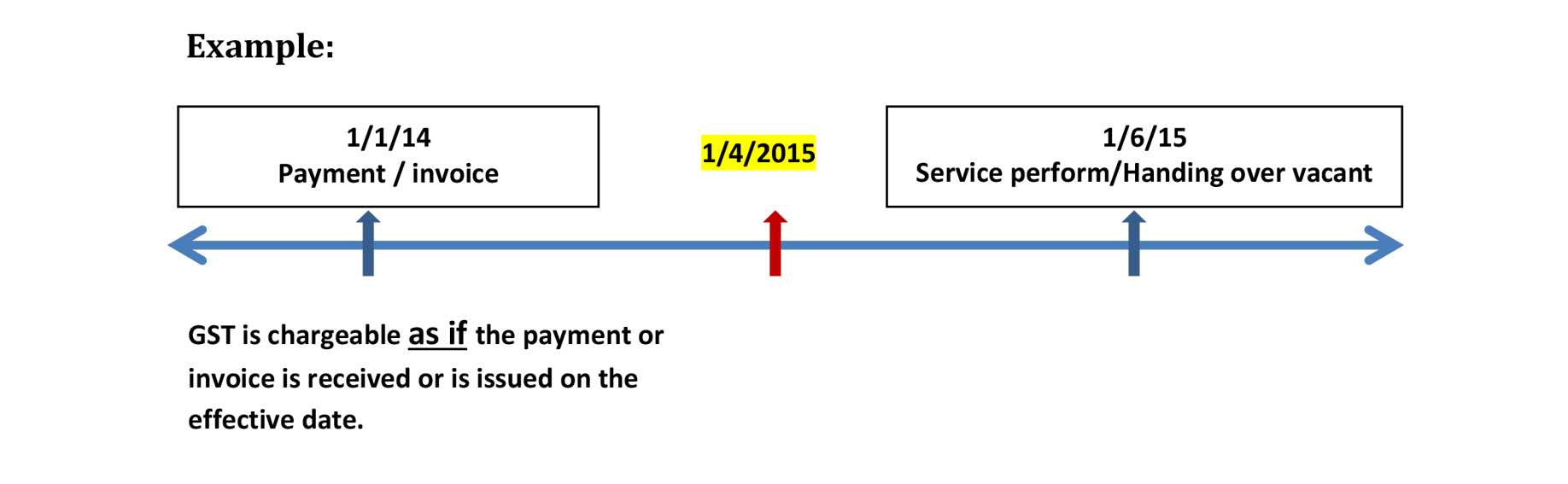

Supply of land or property during transitional period

I have sold a shop lot worth RM1 million. I have made the full payment and S&P signed before 1st April 2015 but the key is handed over on the 5th April 2015? Is the property subject to GST?

Supply of land or property made:

- under agreement for a period or progressively over a period, whether or not at regular intervals and that period begins before the effective date and ends on or after the effective date the proportion of the supply which is attributed to the part of the period on or after the effective date shall be chargeable to tax. (refer s.188 GSTA);

- under agreement but not for a period or progressively over a period or not under agreement, where any payment received or invoice issued before effective date and the supply is on or after effective date, GST is chargeable as if the payment or invoice is received or issued on the effective date (s.183 GSTA).

|

Amendment |

| 10. |

3/2014 |

Item 1:What type of newspapers fall under the GST (Zero-Rated Supply) Order 2014

What type of newspapers fall under the GST (Zero-Rated Supply) Order 2014

- Newspapers listed in the Appendix to the First Schedule under the GST (Zero-Rated Supply) Order 2014 only covers daily or weekly, in the form of unbound sheets of printed matter consisting mainly of current news of general interest, together usually with literary articles on subjects of current, historical, biographical, etc., interest. They also generally devote a considerable amount of space to illustrations and advertisements.

- The zero rating does not include journals and other periodicals, issued weekly, fortnightly, monthly, quarterly or half-yearly, either in the form of newspapers or as paper bound publications. They may be mainly devoted to the publications of intelligence on subject of a specialised nature or sectional interest (e.g., legal, medical, financial, commercial, fashion or sporting), in which case they are frequently published by or for organizations of the interest concerned. Or they may be of more general interest, such as the ordinary fiction magazines. These include periodicals published by or for named industrial concerns (e.g., motor car manufacturers) to promote interest in their products, staff journals normally having circulation only within the industrial, etc., organisations concerned and periodicals such as fashion magazines which may be issued by a trader or an association for publicity purposes.

- The difference between newspapers and journals is the content, frequency, circulation and expiry date as shown below:

| TYPES |

CONTENT |

FREQUENCY |

CIRCULATION |

EXPIRY DATE |

Newspaper

E.g. NST, The Star, Utusan Malaysia, Berita Harian, Sin Chew Jit Poh, Malaysia Nanban, Utusan Borneo or Utusan Sarawak |

Mainly of current news of general interest |

Daily or weekly |

Society at large |

Expires at the time of purchase |

Journal/periodicals

E.g. The Edge, SME, The Times, Reader's Digests, Solusi, Mangga or The Focus |

Mainly devoted to the publications of intelligence on subject of a specialised nature or sectional interest (e.g., legal, medical, financial, commercial, fashion or sporting), |

Any frequency (Amended 7/7/2015) |

Specific segment of the society e.g., industrial, medical practitioners, businesses or automotive within the industrial, political, etc., organisations concerned and periodicals such as fashion magazines which may be issued by a trader or an association for publicity purposes. |

Not applicable |

- Old newspaper is not considered as newspaper. Sale of old newspapers is a standard rated supply because newspaper done for the day would not be sold as a newspaper but more as paper (ordinary meaning i.e. scrap). It can be used as input (recycle) to produce other products (e.g. carton boxes, toilet roll or serviettes). There is also a difference in the tariff code number where the old newspaper falls under the tariff code 4707.30.000 and the tariff code for newspaper is 4902.10.

Item 2:What is the GST treatment on supply made by the healthcare professional?

What is the GST treatment on supply made by the healthcare professional?

- Paragraph 18(3)(b) to the Second Schedule of the GST (Exempt Supply) Order 2014 has defined "healthcare professional" includes a medical practitioner, dental practitioner, pharmacist, clinical psychologist, nurse, midwife, medical assistant, physiotherapist occupational therapist and other allied healthcare professional and any other person involved in the giving of medical, health, dental or pharmaceutical services under the jurisdiction of the Ministry of Health.

- Paragraph 18(2) to the Second Schedule of the GST(Exempt Supply) Order 2014 also defined 'private healthcare facilities' means any premises, other than a Government healthcare facility, used or intended to be used for provision of healthcare services such as private hospital, hospice, ambulatory care centre, nursing home, maternity home, psychiatric hospital, psychiatric nursing home, community mental health centre, haemodialysis centre, medical clinic and dental clinic and such other healthcare premises as specified by the Minister charged with the responsibility for health by notification in the gazettes under the Private Healthcare Facilities and Services Act 1998 (PHFSA).

- Healthcare professional employed (contract of service) by the private healthcare facilities providing healthcare services to patients is treated as making an exempt supply.

- Healthcare professional who is not employed by the private healthcare facilities but provides healthcare services to a private healthcare facility under a contract for service or outsourcing services is treated as making a standard rated supplyto the private healthcare facilities.

|

Amendment |

| 11. |

2/2014 |

Item 1:Motorcar used exclusively for the business purpose as approved by the DG.

Reg. 34 GSTR (Goods and Service Tax Regulations 2014)

Motorcar used exclusively for the business purpose as approved by the DG

To what extend is the application of this provision in term of claiming input tax?

- Reg. 36 GSTR (Goods and Service Tax Regulation 2014), provides that a taxable person is not allowed to claim input tax in respect of -

- the supply to or importation by him of a passenger motorcar; or

- the hiring of motorcar;

- A 'passenger motor car' is defined in reg. 34 GSTR as a motor car which is constructed or adapted for the carriage of not more than nine passengers inclusive of the driver and the unladed weight of which does not exceed three thousand kilograms but does not include any motor car which is used exclusively for the purposes of business as may be approved by the Director General (reg. 34(e) GSTR).

- Motor cars used exclusively for business purposes which the Director General may approve are - (Substitute with new item on 23/3/2015)

- Test Drive car - a car used for a limited period in order to assess its performance and reliability. (Only for car dealers);

- Cars used for security purposes - a car used by security officers only for patrol in the company's compound to protect the business premise;

- Cars used in providing technical assistance - a car used mainly in providing technical assistance to company's clients e.g. maintenance services, breakdown services, repair services; or

- Serve as an integral part in the running of a business (cannot continue business without them). It is a business that requires the use of passenger motor cars e.g. leasing of cars, taxi rental business;

AND

- The cars in (a), (b), (c) or (d) above must fulfil all the following conditions -

- the motor car is registered in the name of the company;

- the motor car is not let on hire;

- there is no intention to make the motor car available for private use;

- the motor car is kept at business premises, used for business trips and must not be taken home overnight by any employee; AND

- the business's name or company's LOGO must be printed on the body of the car.

- There are motor cars exclusively used for business purpose which Director General may not approve, such as -

- Assigned Car

Assigned car is a car that is assigned to an individual for their full-time use within the parameters of the company's policies and procedures. It is a privilege given to the individual which comes with the post e.g. cars for directors.

- Pooled Car

Pooled cars are cars that are readily available exclusively for business use by a number of employees.

- Cars used in sales and marketing

The car is commonly used in retail business to promote sales and marketing e.g. cars used by salesman in marketing new products.

- Demo or display car used to promote new model and usually display in a show room.

Item 2:Claiming input tax on business expenses billed to employees.

Claiming input tax on business expenses billed to employees

Below are expenses usually billed to employees and not to the businesses, can the businesses claim the input tax and how?

- Car park and other travelling expenses incurred while visiting customers or on working trips;

- Mobile phone bill expenses for making business calls on a line registered in their own name;

- Entertainment meals with existing customers;

- Hotel accommodation while on outstation business trip

- A registered person claiming input tax must hold a valid document (tax invoice) under his name which is required to be provided under section 33 GSTA (Goods and Service Tax Act 2014) (refer section 33 GSTA and reg.38(1)(a)(i) GSTR)

- Invoice under employees name cannot be used for claiming input tax EXCEPT for mobile phone bill expenses used for business purpose

- A registered person can use the mobile phone invoice billed to his employee for claiming input tax as long as the expenses are reimbursed and accounted as business expenses.

Item 3:Taxable period: The first taxable period for company with financial year end on 31st August and revenue below RM5 million

Taxable period

What is the first taxable period for company with financial year end on 31st August and the revenue is below RM5 million, is it -

- 1st April 2015 to 30th June 2015, second period 1st July 2015 to 30th September 2015?

OR

- 1st April 2015 to 31st May 2015, second period 1st June 2015 to 31st August 2015 (to match with financial year end)?

The first taxable period must coincide with financial year of the business. Therefore the taxable period will be on 1st April 2015 to 31st May 2015, second period is 1st June 2015 to 31st August 2015 and third period is 1st September to 30th November 2015

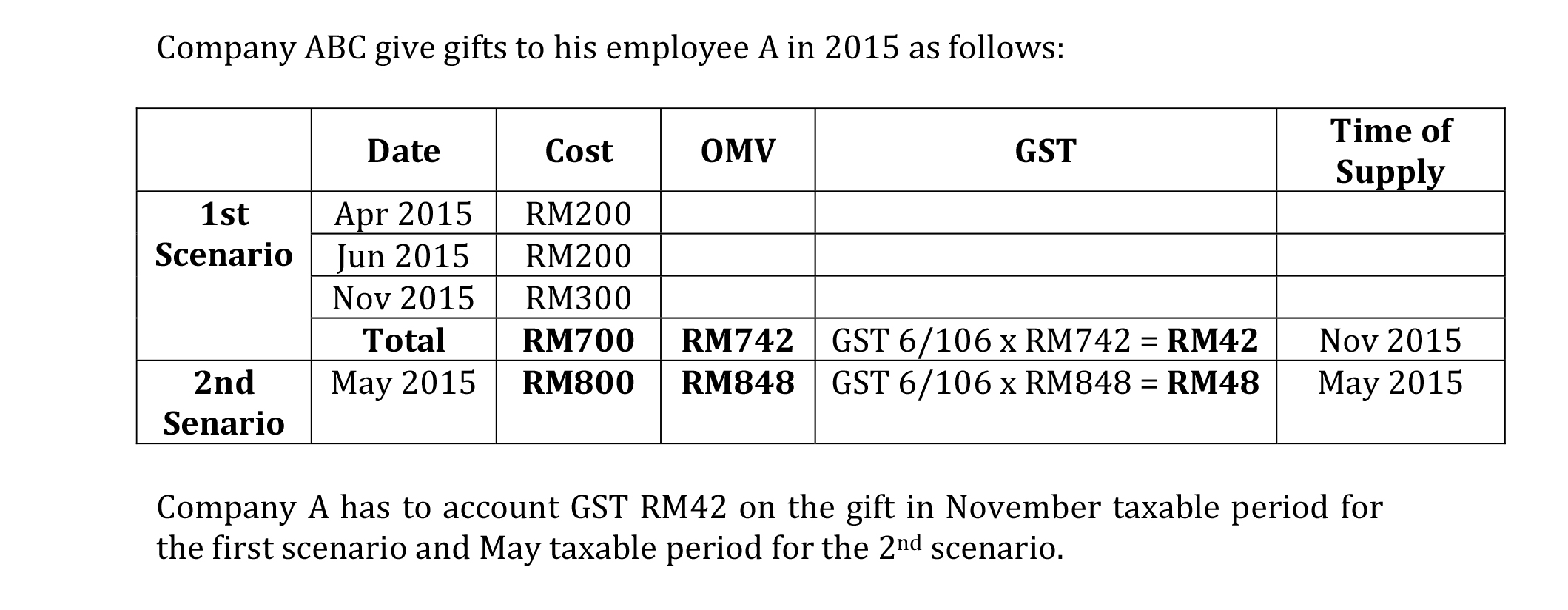

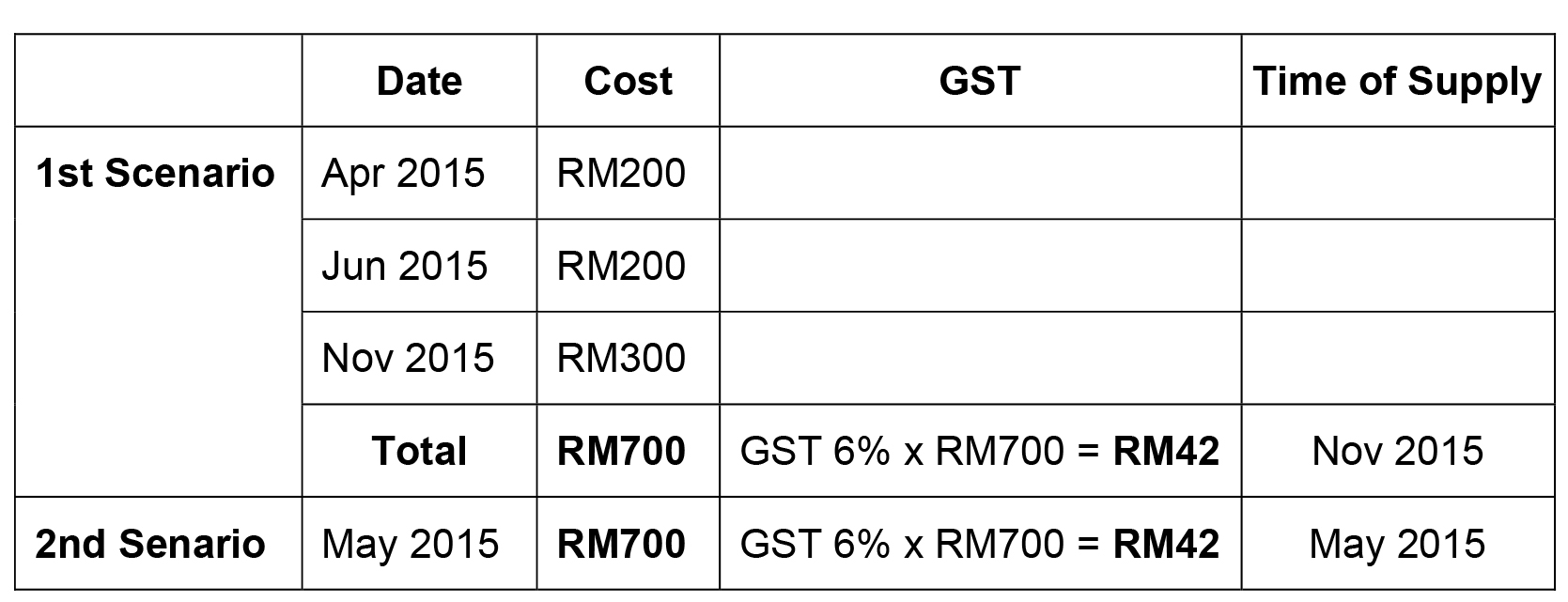

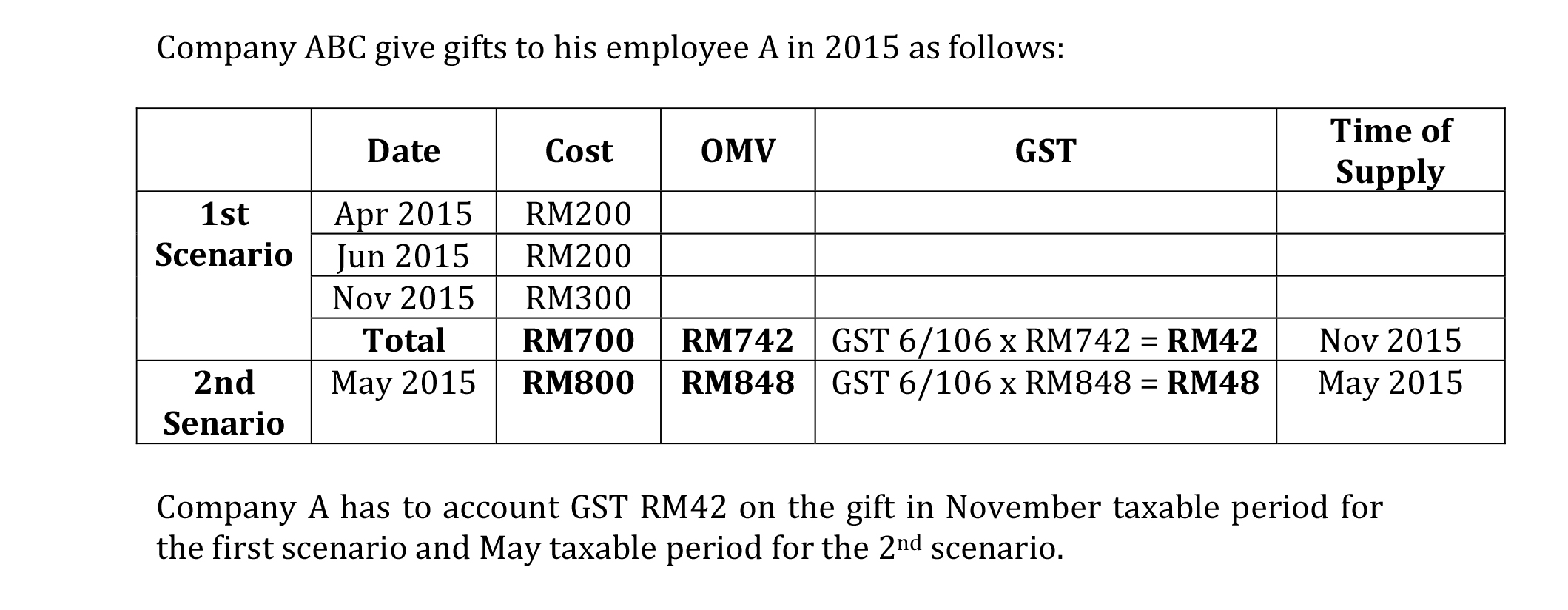

Item 4:Gift rule

Gift rule

How to determine the GST on gift?

- Para 5(2)(a) of the First Schedule of GSTA 2014:

No GST will be charged on gift made in the course or furtherance of business to the same person in the same year where the total cost of the gift to the donor does not exceed RM500. If the total cost to the donor is more than RM500, GST need to be accounted for and input tax is claimable.

- The word 'year' in paragraph 5(2) (a) of the First Schedule of GSTA 2014 refers to 'tax year' (financial year).

- Gift bought by a taxable person from a non-GST registered person worth more than RM500 and given free without consideration is not subject to GST but no input tax is claimable as the gift is acquired without tax.

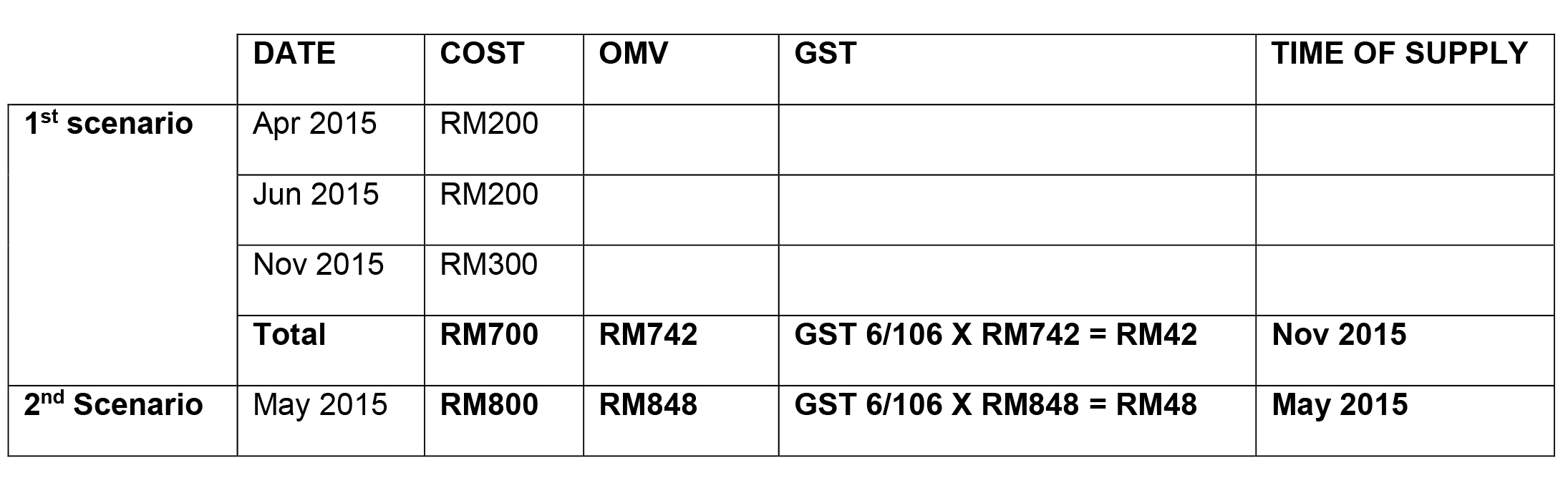

- Determination of RM500 per person per year is the aggregate of all gifts given in the tax year. If the total cost exceeds RM500, it is subject to GST (account for output tax) as follows -

Example : (Amended 23/3/2015)

Item 5:Voluntary Registration for pre commencement of business

Voluntary Registration for pre commencement of business

- A person who intends to make any taxable supplies can apply for voluntaryregistration if he can satisfy that he is committed to do business by submitting thefollowing documents:

- details of business arrangements (e.g. business plans, plants and location);

- copies of contract for establishment of premises such as rental of premises/construction of pipelines/ purchase of equipment;

- details of any patents;

- details of business purchases; or

- other documentary supporting evidence.

AND;

- The first taxable supply is made within 12 months from the date of application. (wef 28/10/2015)

Item 6:Supply goods to company branch in Designated Area

Supply goods to company branch in Designated Area

XYZ Company in Kuala Lumpur (not in Designated Area @ DA) purchases goods from ABC Company in Kuantan and request ABC Company to send the goods to his branch in Langkawi (Designated Area). What is the GST treatment on the goods send to Langkawi?

- Goods supplied to a Designated Area (Labuan, Langkawi and Tioman) from Malaysia (other than Designated Area) are zero rated supply (refer Item 3 First Schedule of GST (Zero Rate Supply) Order 2014)

- The supply made by ABC company to XYZ Company in Kuala Lumpur is a standard rated supply and not zero rated supply unless -

- there is evidence showing -

- the goods are moved or shipped directly to XYZ branch in Langkawi (DA);

- the exporter or consignor in the export form or shipping documents is in the name of ABC Company and the goods are exported to or consigned to XYZ branch in Langkawi; and

- the invoice issued by ABC Company to XYZ Company in Kuala Lumpur has indication that the have been directly shipped to XYZ branch in Langkawi'.

Item 7:Agent and foreign Principal

Agent and foreign Principal

A foreign company making taxable supply in Malaysia has to appoint an agent to act on his behalf. The registration of a foreign principal will be under the name of such foreign principal. Who will be the importer and who is eligible to claim input tax In the case of a registered foreign principal importing goods for the purpose of making supply in Malaysia?

- Section 65(6) GSTA, provides that an agent appointed by a person who does not belong to Malaysia to act on his behalf shall be liable for the tax and the other requirements imposed under the GSTA as if he is the person who does not belong to Malaysia.

- Only importer, consignee or owner of the goods imported can claim input tax in relation to importation of goods. (refer reg.38(1)(d) GSTR).

- For the purpose of importing goods into Malaysia by the foreign principal, the appointed agent under section 65(6) GSTA can appear as the importer in Customs Form No.1 and care off @ c/o the name of the foreign principal. Based on the Customs Form No.1, the foreign principal may issue an authorisation letter to the appointed agent for claiming input tax on his behalf.

Item 8:Claiming Special Refund for goods held on hand on 1/4/2015

Claiming Special Refund for goods held on hand on 1/4/2015l

i) For goods held on hand on 1/4/2015, can a stock count be performed on a date other than 1/4/2015?

ii) Who should certify the claims for special refund?

iii) How to calculate the value of the goods held on hand on 1/4/2015?

- Any person who is entitled to a special refund for goods held on hand on 1/4/2015 under sec. 190 GSTA shall be eligible to claim once;

- The claim for special refund shall be made in a form as the DG may determine, not later than 6 months from 1/4/2015 (refer sec.191(1)GSTA);

- Any person claiming the special refund should perform a stock count on goods held on hand on 1/4/2015. However, if the stock count is not done on 1/4/2015, they are allowed to use the results of stock count which has been performed in the past 6 months from 1/4/2015 and then applying the roll forward method to arrive at the stock balances on 1/4/2015. Alternatively, a stock count can be performed in a period no later than 6 months after 1/4/2015 and then applying the roll backward method.

Under all circumstances, a stock count must be performed within the stipulated time periods, otherwise no special refund will be approved.

- If the amount of special refund is less than RM10,000, a chartered accountant as conferred by Malaysian Institute of Accountants should certify the amount of the special refund (sec. 191(2)(a)GSTA).

If the amount of special refund is RM10,000 or more, an approved company auditor under section 8 of the Companies Act 1965 should certify the amount of the special refund (sec. 191(2)(b)GSTA). A Reasonable Assurance Report performed under the Malaysian Approved Standard on Assurance Engagements, ISAE 3000, Assurance Engagements Other than Audits orReviews of Historical Financial Information will need to be issued to support the special refund.

- The value of the goods held on hand on 1/4/2015 for purposes of the special refund can be ascertained as follows:

- Specific identification

If the goods held on hand on 1/4/2015 can be attributed to invoice or Customs Form No. 1, based on specific description, series, no products, brands or other specific identification, such invoice or Customs Form No.1 shall be used.

Example:

Goods with serial number ABC123 and the related invoices are invoices issued on 3rd February 2014 as the serial number of ABC123 appeared on the invoices. The value in such invoices can be used for the special refund.

- First in First out (FIFO)

If the goods held on hand on 1/4/2015 can be directly associated with many invoices due to general product description, value on the latest invoice before the 1/4/2015 shall be used. If the quantity of goods held on hand exceeds the quantity stated in such invoice, the value for the remaining number of goods should be based on the quantity that can be covered in the previous invoices issued in sequence prior to the final invoice before the 1/4/2015.

Example:

| Total goods held on hand on 1st April 2015 |

Related Invoice |

Sales Tax Paid |

| Description |

Quantity |

Date |

Quantity |

Price per unit (RM) |

Per unit (RM) |

| Sandal |

3000 unit |

1st March 2015 |

800 unit |

2.00 |

0.20 |

|

|

15th Dec 2014 |

1,500 unit |

1.80 |

0.18 |

|

|

1st Jun 2014 |

2,500 unit |

1.70 |

0.17 |

The value for claiming special refund -

(800 X RM0.20) + (1,500 X RM0.18) + (700 X RM0.17) = RM549 |

|

- The value determined as in sub (v) can only be used when payment to the supplier has been made.

Example:

From the above example, If the latest invoice before 1st April 2015 (1st March 2015) has not been paid by a taxable person, the value for claiming special refund will be -

(1,500 X RM0.18) + (700 X RM0.17) = RM389

|

Amendment |

| 12. |

1/2014 |

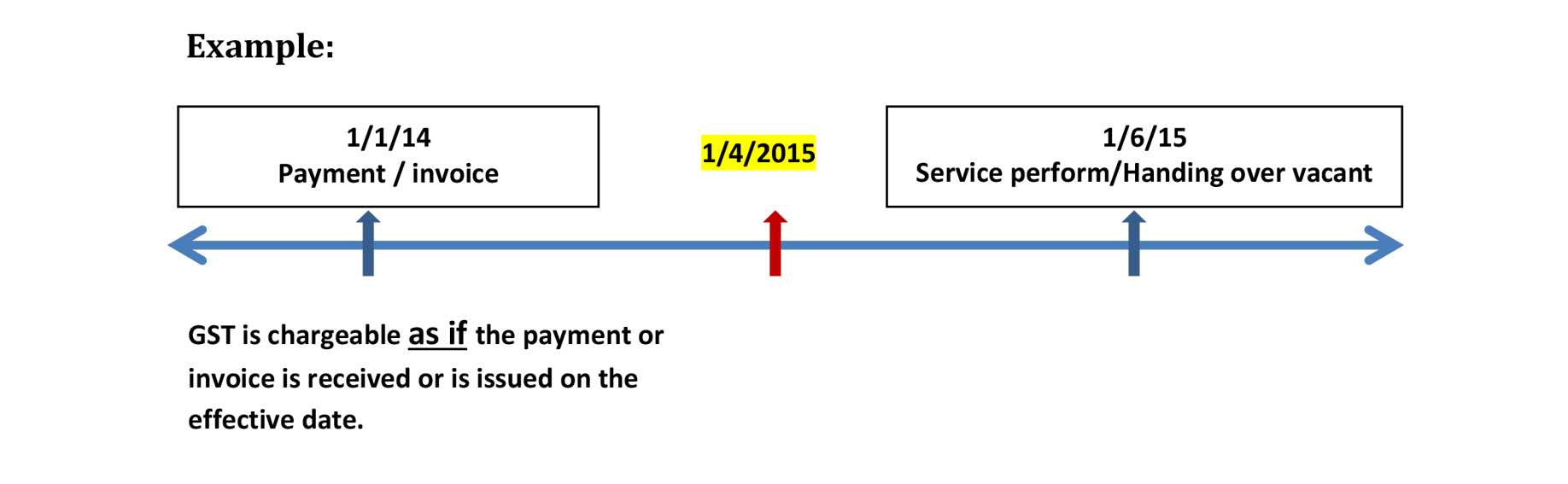

Item 1:Issuance of invoice before effective date for supply made on or after effective date

Issuance of invoice before effective date for supply made on or after effective date.

- No invoice with indication of GST can be issued before the implementation date. (sec.183(1) Goods and Service Tax Act 2014 (GSTA 2014)

- The supplier has to account for output tax on the supply made on or after 1/4/2015 even though invoice is issued or payment is received before 1/4/2015. The payment received and invoice issued is taken to have been received or issued on 1/4/2015 (sec 183 GSTA 2014)

- The value on the payment received or invoice issued shall be deemed to be inclusive of GST

- Claiming of input tax. After 1/4/15, a GST registered person can claim input tax based on the invoice issued before 1/4/15 as long as the GST ID number of the supplier is stated on the invoice.

Item 2:Accounting for GST on imported services.

Accounting for GST on imported services

- S.13(4) GSTA 2014 provides that the time of supply for imported services shall, to the extend covered by any payment by the recipient, be treated to have been made when the supplies are paid for

- A GST registered person however may account for output tax based on the date of invoice if it is issued earlier than the date of payment

- The value for imported services is tax exclusive

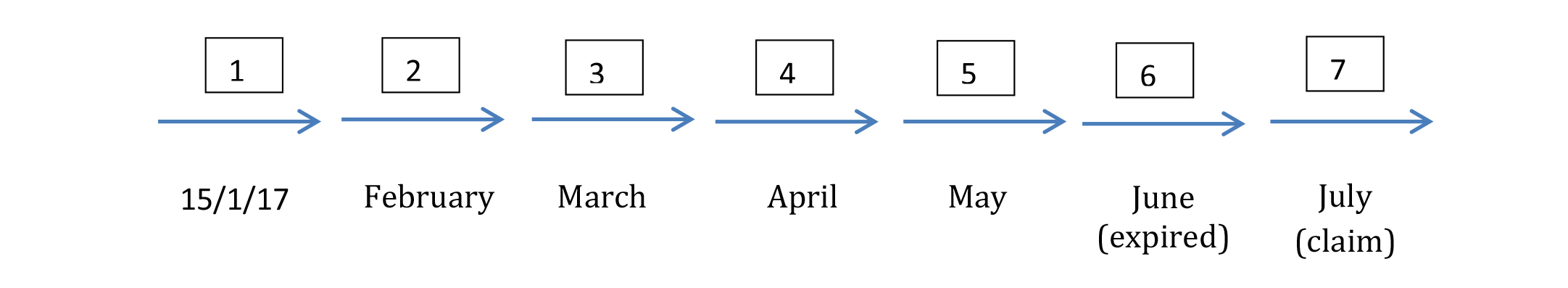

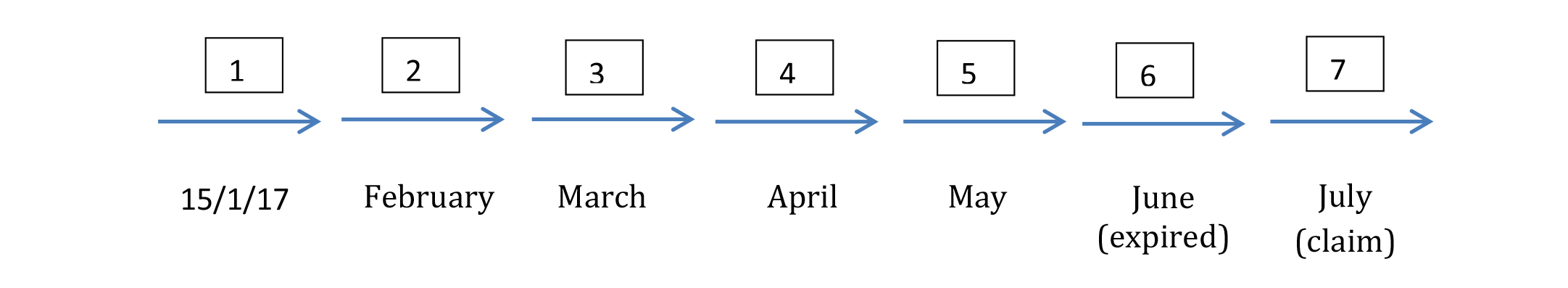

Item 3:Claiming bad debt relief.

Claiming bad debt relief

- A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply fromthe debtor after the sixth month from the date of supply.

- The bad debt relief may be claimed if - (wef 28/10/2015)

- requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and

- the supply is made by a GST registered person to another GST registered person; and

- The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. (wef 28/10/2015)

- If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date. (wef 28/10/2015)

- A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax immediately after the expiry of the sixth month (s.38(9) GSTA) (wef 28/10/2015)

- The word 'month' in sec.58 refers to calendar month or complete month -

Example: Invoice issued at 15th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in July taxable period.

Item 4:Royalty

Royalty

If royalty has already been included into the customs value during importation, what is the GST treatment on royalty under sec. 13 GSTA 2014?

- Supply of royalty is a supply of services.

- GST need to be accounted for on any payment made in relation to imported goods, however if the royalty has been included into customs value when the declaration was made at the time of import, no GST on such royalty need to be charged separately as imported services.

Item 5:GST treatment on drop shipment

GST treatment on drop shipment

- (Deleted 7/7/2015. Please refer to DG's Decision 4/2015)

- (Deleted 7/7/2015. Please refer to DG's Decision 4/2015)

- Company ABC in Malaysia (not in Designated Area @ DA) purchases goods from company XYZ in Shah Alam and request the company XYZ to send the goods to ABC's client (MRS company) in Langkawi (Designated Area). Whether the supply made by the company XYZ to company ABC subject to GST?

- The supply made by company XYZ to company ABC is a standard rated supply because the transfer of ownership of the goods took place in Malaysia and not in DA;