GST News

NOTIFICATION OF PENALTY DUE TO FAILURE/LATE PAYMENT OF GOODS AND SERVICES TAX

22

03/2016In accordance with amendments made to Section 41 of the Goods and Services Tax Act 2014, with effect from 1/1/2016 failure to pay the amount of goods and services tax to be paid within the period specified will be penalized. Imposition of penalties will start for the taxable period for which tax payments are due and payable on 31/1/2016.

The calculation of the penalty will be based on the number of days the tax due is not paid as per the table below:-

NUMBER OF DAYS TAX DUE IS NOT PAID |

RATES OF PENALTY (%) |

1 - 30 |

5 |

1 - 60 |

15 |

1 - 90 |

25 |

> 90 |

25 (maximum) |

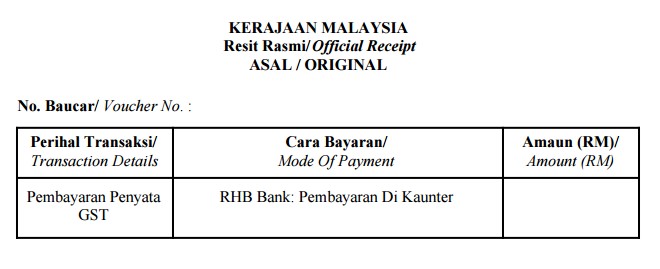

Official Receipt for GST03 & GST04 Payment at the GST Processing Center (GPC) counter

07

03/2016Official Receipt for GST03 & GST04 Payment at the GST Processing Center (GPC) counter.

Commencing from December 21, 2015, the GST03 & GST04 payment transaction made through the GST Processing Center (GPC) counter will be processed as a payment through a bank counter.

Official receipt will be issued as follows:

Customs Call Center Operation (CCC) Hours for Thaipusam Public Holiday

13

01/2016Please be informed, Customs Call Center (CCC) will operate on Thaipusam (24 January 2016) as follows:

24 January 2016 (Sunday)

Operation Hours : 8.30 am - 5.00 pm

25 January 2016 (Monday)

Operation Hours : 8.30 am – 10.00 pm

EFFECTIVE 1st OCTOBER 2015 THE USE OF POINT OF SALE SYSTEM OR CASH REGISTER MACHINE FOR ISSUING TAX INVOICE

13

01/2016Effective 1st October 2015

THE USE OF POINT OF SALE SYSTEM OR CASH REGISTER MACHINE FOR ISSUING TAX INVOICE IS MANDATORY FOR THE FOLLOWING CATEGORIES OF BUSINESS (RETAILERS).

- HARDWARE STORE

- RESTAURANT INCLUDING COFFEE HOUSE

- MINI MARKET AND GROCERY STORE

- BOOK STORE

- PHARMACY

- ENTERTAINMENT CENTRE

OTHER THAN THE CATEGORIES MENTIONED ABOVE, SUCH BUSINESSES MAY ISSUE COMPUTER GENERATED OR PRE-PRINTED TAX INVOICES.